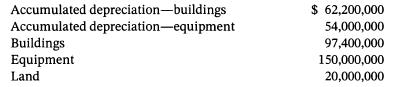

At January 1, 2025, Youngstown Company reported the following property, plant, and equipment accounts: The company uses

Question:

At January 1, 2025, Youngstown Company reported the following property, plant, and equipment accounts:

The company uses straight-line depreciation for buildings and equipment, its year-end is December 31, and it makes adjusting entries annually. The buildings are estimated to have a 40 -year useful life and no salvage value; the equipment is estimated to have a 10-year useful life and no salvage value.

During 2025, the following selected transactions occurred:

Apr. 1 Purchased land for \(\$ 4.4\) million. Paid \$1.1 million cash and issued a 3-year, \(6 \%\) note payable for the balance. Interest on the note is payable annually each April 1.

May 1 Sold equipment for \(\$ 300,000\) cash. The equipment cost \(\$ 2.8\) million when originally purchased on January 1, 2017.

June 1 Sold land for \(\$ 3.6\) million. Received \(\$ 900,000\) cash and accepted a 3-year, \(5 \%\) note for the balance. The land cost \(\$ 1.4\) million when purchased on June 1, 2019. Interest on the note is due annually each June 1 .

July 1 Purchased equipment for \(\$ 2.2\) million cash.

Dec. 31 Retired equipment that cost \$1 million when purchased on December 31, 2015. No proceeds were received.

Instructions

a. Journalize the above transactions.

b. Record any adjusting entries for depreciation required at December 31 .

c. Prepare the property, plant, and equipment section of the company's balance sheet at December 31.

Step by Step Answer:

Financial Accounting Tools For Business Decision Making

ISBN: 9781119791089

10th Edition

Authors: Paul D. Kimmel, Jerry J. Weygandt, Jill E. Mitchell