Question: Grouper Company provides you with the following balance sheet information as of December 31, 2025. In addition, Grouper reported net income for 2025 of ($

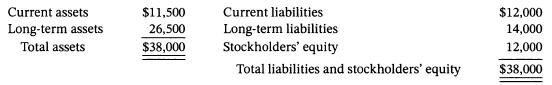

Grouper Company provides you with the following balance sheet information as of December 31, 2025.

In addition, Grouper reported net income for 2025 of \(\$ 16,000\), income tax expense of \(\$ 3,200\), and interest expense of \(\$ 1,300\).

a. Compute the current ratio and working capital for Grouper for 2025.

b. Assume that at the end of 2025 , Grouper used \(\$ 3,000\) cash to pay off \(\$ 3,000\) of accounts payable. How would the current ratio and working capital have changed?

c. Compute the debt to assets ratio and the times interest earned for Grouper for 2025.

Current assets Long-term assets Total assets $11,500 26,500 $38,000 Current liabilities Long-term liabilities Stockholders' equity Total liabilities and stockholders' equity $12,000 14,000 12,000 $38,000

Step by Step Solution

3.40 Rating (163 Votes )

There are 3 Steps involved in it

a Current ratio 1150012000 961 Working capi... View full answer

Get step-by-step solutions from verified subject matter experts