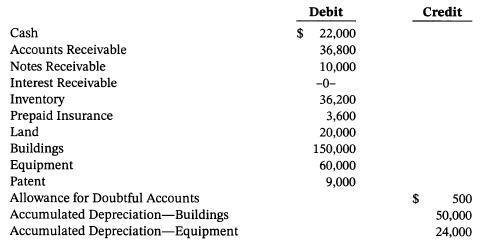

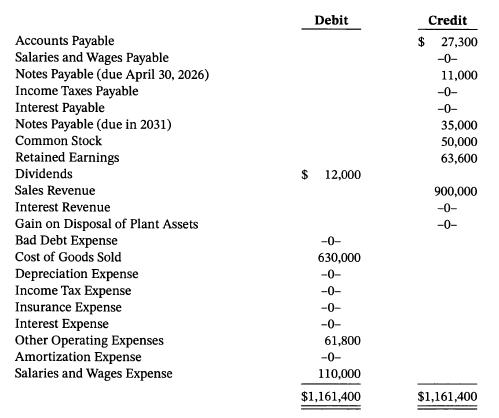

Milo Corporation's unadjusted trial balance at December 1, 2025, is presented below. The following transactions occurred during

Question:

Milo Corporation's unadjusted trial balance at December 1, 2025, is presented below.

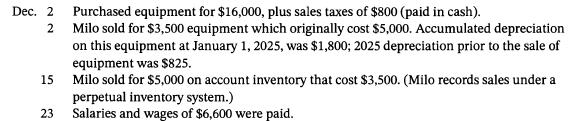

The following transactions occurred during December.

Adjustment data:

1. Milo estimates that uncollectible accounts receivable at year-end are $4,000.

2. The note receivable is a 1-year, 8% note dated April 1, 2025. No interest has been recorded.

3. The balance in prepaid insurance represents payment of a $3,600, 6-month premium on September 1, 2025.

4. The building is being depreciated using the straight-line method over 30 years. The salvage value is $30,000.

5. The equipment owned prior to this year is being depreciated using the straight-line method over 5 years. The salvage value is 10% of cost.

6. The equipment purchased on December 2, 2025, is being depreciated using the straight-line method over 5 years, with a salvage value of $1,800.

7. The patent was acquired on January 1, 2025, and has a useful life of 9 years from that date.

8. Unpaid salaries at December 31, 2025, total $2,200.

9. Both the short-term and long-term notes payable are dated January 1, 2025, and carry a 10% interest rate. All interest is payable in the next 12 months.

10. Income tax expense was $15,000. It was unpaid at December 31.

Instructions

a. Prepare journal entries for the transactions listed above and adjusting entries.

b. Prepare an adjusted trial balance at December 31, 2025.

c. Prepare a 2025 income statement and a 2025 retained earnings statement.

d. Prepare a December 31, 2025, balance sheet.

Step by Step Answer:

Financial Accounting Tools For Business Decision Making

ISBN: 9781119791089

10th Edition

Authors: Paul D. Kimmel, Jerry J. Weygandt, Jill E. Mitchell