A, B and C are partners sharing profits and losses in the ratio of 3 : 3

Question:

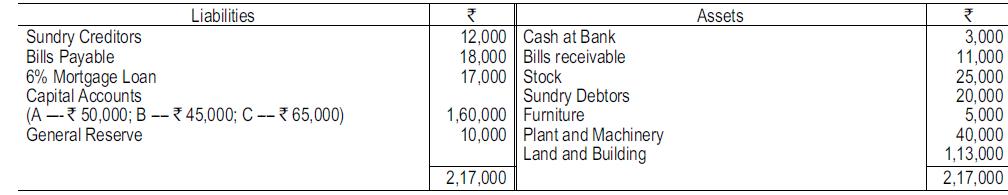

A, B and C are partners sharing profits and losses in the ratio of 3 : 3 : 4. The Balance Sheet as on 31.12.2017 is :

The firm earned profits as follows for the past five years: 2013 ---- ₹14,000; 2014 ---- ₹16,500; 2015 ---- ₹15,000; 2016 ---- ₹15,000 and 2017 ---- ₹15,800.

On December 31, 2017, C retired from partnership and in order to ascertain the amount due to C, the accounts of 2017 were verified and the following mistakes were detected:

(i) A bill receivable for ₹1,000 which was dishonoured and became irrecoverable, was not taken into consideration while preparing the final accounts.

(ii) An amount of ₹200 paid for the rent of the house occupied by C was wrongly debited to the Rent Account of the firm.

(iii) Goods worth ₹1,500 given by B to the firm were not taken into account.

(iv) An outstanding bill for ₹500 towards electricity was not paid and the same was not adjusted while preparing the final accounts.

(v) Purchase of machinery of July 1, 2017 at a cost of ₹9,500 was wrongly treated as the Purchase Account and the expenses of ₹500 incurred towards erection of the machinery were charged to the Machinery Repairs Account. Depreciation on the Machinery Account was charged at 10% p.a.

The partners agreed to rectify the mistakes noted above and the following adjustments were made to settle the accounts of C:

(i) A provision was made at 5% on Sundry Debtors

(ii) Stock was revalued at ₹21,925

(iii) Plant and Machinery were depreciated by 15%

(iv) Land and building were appreciated by 20%

(v) Sundry creditors for ₹2,900 will not rank

(vi) Goodwill of the firm should be ascertained at three times the average profit of the last five years. The Goodwill Account should not appear in the books. Goodwill of C should be shared by A and B

(vii) The Capital of C should be purchased by A and B in the ratio of 3:2

(viii) Since C was in urgent need of ₹50,000, the partners are required to make payment to him in cash in their new profit-loss sharing ratio and the balance of C’s capital will be treated as loan

(ix) The partners are also required to adjust their capitals in cash in proportion to their new profit-loss sharing ratio. You are required to prepare the Profit and Loss Adjustment Account, Revaluation Account, Capital Accounts of the partners and also the Balance Sheet after the retirement of C.

Step by Step Answer:

Financial Accounting Volume II

ISBN: 9789387886230

4th Edition

Authors: Mohamed Hanif, Amitabha Mukherjee