Arbor Company had 200,000 outstanding shares of common stock, par value $1 per share. On January 10

Question:

Arbor Company had 200,000 outstanding shares of common stock, par value $1 per share. On January

10 of the current year, Cardinal Corporation purchased some of Arbor’s shares as a long-term investment

at $12 per share. At the end of the current year, Arbor reported the following: income, $90,000, and cash

dividends declared and paid during the year, $15,000. The fair value of Arbor Company stock at the end

of the current year was $14 per share.

Required:

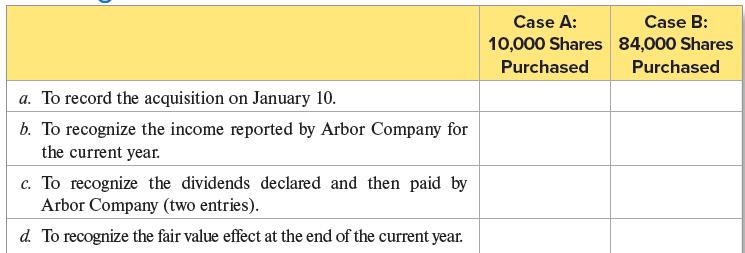

1. For both of the following cases (Case A and Case B, shown in the tabulation), identify the method of

accounting that Cardinal Corporation should use. Explain why.

2. Give the journal entries for Cardinal Corporation at the dates indicated for each of the two independent

cases (Case A and Case B), assuming that the investments will be held long term. Use the following

format:

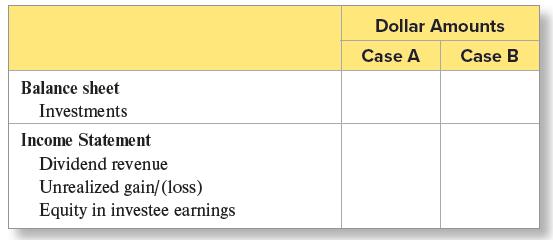

3. Complete the following schedule to show the separate amounts that should be reported on the current

year’s financial statements of Cardinal Corporation:

Step by Step Answer:

Financial Accounting

ISBN: 9781264229734

11th Edition

Authors: Robert Libby, Patricia Libby, Frank Hodge