As chief lending officer for a bank, you need to decide whether to make a loan toThe

Question:

Required

RequiredPart A. The Ratio Analysis Model

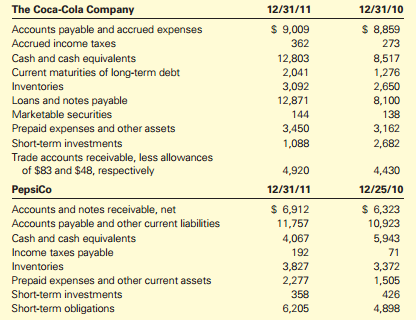

A banker must be able to assess a company€™s liquidity before loaning it money. Liquidity is the ability of a company to pay its debts as they come due. Replicate the five steps in the Ratio Analysis Model on page 74 to analyze the current ratios for The Coca-Cola Company and PepsiCo:

1. Formulate the Question

2. Gather the Information from the Financial Statements

3. Calculate the Ratio

4. Compare the Ratio with Other Ratios

5. Interpret the Ratios

Part B. The Business Decision Model

A banker must consider a variety of factors, including financial ratios, before making a loan. Replicate the five steps in the Business Decision Model on page 75 to decide whether to make a loan to The Coca-Cola Company.

1. Formulate the Question

2. Gather Information from the Financial Statements and Other Sources

3. Analyze the Information Gathered

4. Make the Decision

5. Monitor Your Decision

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Accounting The Impact on Decision Makers

ISBN: 978-1285182964

9th edition

Authors: Gary A. Porter, Curtis L. Norton

Question Posted: