Bajaj Auto Ltd is Indias leading two wheeler manufacturers with expertise in manufacturing high end motorcycles. Established

Question:

Bajaj Auto Ltd is India’s leading two wheeler manufacturers with expertise in manufacturing high end motorcycles. Established in 1945, Bajaj Auto Ltd. was incorporated as a trading company. Till 1959, they imported scooters and three-wheelers from Italy and sold them in India. The company got a production license in the year 1959 and fastened a technical collaboration with Italian PIAGGIO in 1960. Today, Bajaj Auto Ltd. is India’s second largest 2-wheeler companies in terms of market capitalization and annual turnover.

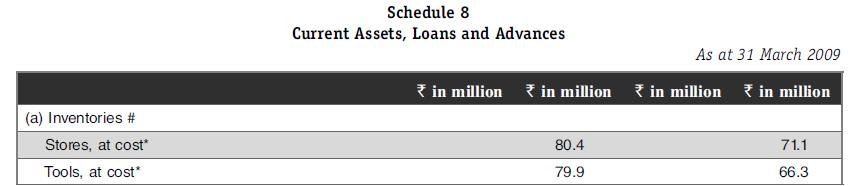

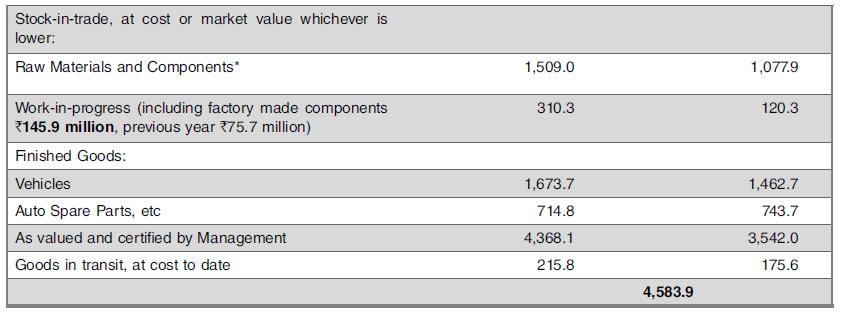

The notes to accounts of the company included the following lines:

Inventories

Cost of inventories have been computed to include all costs of purchases, cost of conversion and other costs incurred in bringing the inventories to their present location and condition.

(a) Finished stocks, Auto spare parts and Work-in-progress are valued at cost or net realizable value whichever is lower. Finished stocks lying in the factory premises, Branches, Depots are valued inclusive of excise duty.

(b) Stores and Tools are valued at cost arrived at on weighted average basis. However, obsolete and slow moving items are valued at cost or estimated realizable value whichever is lower.

(c) Raw materials and components are valued at cost arrived at on weighted average basis or lower of cost and net realizable value, as circumstances demand. However, obsolete and slow moving items are valued at cost or estimated realizable value whichever is lower.

(d) Machinery spares and Maintenance materials are changed out as expense in the year of purchase. However, Machinery spares forming key components specific to a machinery and held as insurance spares are capitalized along with the cost of the Asset.

(e) Goods in transit are stated at actual cost incurred upto the date of Balance Sheet.

Case Questions

(a) What is the inventory valuation method used by the company? Why are some items being valued at estimated realization value?

(b) What is the importance of the opening stocks, purchases, and closing stocks?

(c) Will Bajaj Auto have a “change in stocks” item in its financial statements? If yes then where shall that get reflected? Discuss.

(d) Ind-AS enables better financial reporting practices – given the same, do you suggest any change in the representation of the above items and the notes.

(e) For someone deep into creative accounting, suggest few steps to ensure that the above items be managed to achieve each degree of ‘earnings management’ (see Section 10.4). Discuss.

Step by Step Answer:

Financial Accounting For Management

ISBN: 9789385965661

4th Edition

Authors: Neelakantan Ramachandran, Ram Kumar Kakani