Question: Based upon the T accounts in Exercise 2-13, prepare the nine journal entries from which the postings were made. Journal entry explanations may be omitted.

Based upon the T accounts in Exercise 2-13, prepare the nine journal entries from which the postings were made. Journal entry explanations may be omitted.

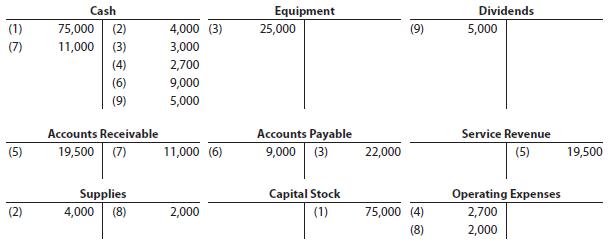

Data From Exercise 2-13:

Grand Canyon Tours Co. is a travel agency. The nine transactions recorded by Grand Canyon Tours during April 2014, its first month of operations, are indicated in the following T accounts:

Indicate for each debit and each credit: (a) whether an asset, liability, stockholders’ equity, dividends, revenue, or expense account was affected and (b) whether the account was increased (+) or decreased (–). Present your answers in the following form, with transaction (1) given as an example:

Step by Step Solution

3.49 Rating (159 Votes )

There are 3 Steps involved in it

Here are the journal entries based on the information provided in Exercise 213 Transaction 1 Account ... View full answer

Get step-by-step solutions from verified subject matter experts