Bike World, Inc., wholesales a line of custom road bikes. Bike World?s inventory as of November 30,

Question:

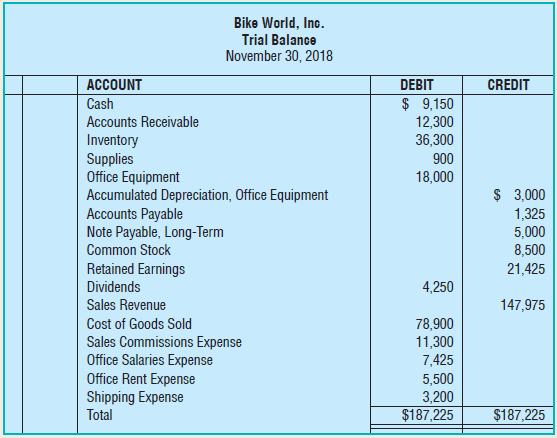

Bike World, Inc., wholesales a line of custom road bikes. Bike World?s inventory as of November 30, 2018, consisted of 22 mountain bikes costing $1,650 each. Bike World?s trial balance as of November 30 appears as follows:

During the month of December 2018, Bike World, Inc., had the following transactions:

Dec 4 Purchased 10 bikes for $1,575 each from Truspoke Bicycle, Co., on account. Terms, 2/15, n/45, FOB destination.6 Sold 14 bikes for $2,100 each on account to Allsport, Inc. Terms, 3/10, n/30, FOB destination.8 Paid $375 freight charges to deliver goods to Allsport, Inc.10 Received $7,200 from Cyclemart as payment on a November 17 sale. Terms were n/30.12 Purchased $450 of supplies on account from Office Express. Terms, 2/10, n/30, FOB destination.14 Received payment in full from Allsport, Inc., for the December 6 sale.16 Purchased 15 bikes for $1,600 each from Truspoke Bicycle, Co., on account. Terms, 2/15, n/45, FOB destination.18 Paid Truspoke Bicycle, Co., the amount due from the December 4 purchase in full.19 Sold 18 bikes for $2,125 each on account to Columbia Cycle, Inc. Terms, 2/15, n/45, FOB shipping point.20 Paid for the supplies purchased on December 12.22 Paid sales commissions, $1,850.30 Paid current month?s rent, $500.31 Paid Truspoke Bicycle, Co., the amount due from the December 16 purchase in full.

Requirements

1. Using the transactions previously listed, prepare a perpetual inventory record for Bike World, Inc., for the month of December. Bike World, Inc., uses the FIFO inventory costing method. (Bike World records inventory in the perpetual inventory record net of any discounts, as it is company policy to take advantage of all purchase discounts.)

2. Open four-column general ledger accounts and enter the balances from the November 30 trial balance.

3. Record each transaction in the general journal using the ?net? method for purchases and sales. Explanations are not required. Post the journal entries to the general ledger, creating new ledger accounts as necessary. Omit posting references. Calculate the new account balances.

4. Prepare an unadjusted trial balance as of December 31, 2018.

5. Journalize and post the adjusting journal entries based on the following information, creating new ledger accounts as necessary:Depreciation expense on office equipment, $1,875Supplies on hand, $245Accrued salary expense for the office receptionist, $845Estimated refund liability, $1,320Cost of estimated inventory returns, $742

6. Prepare an adjusted trial balance as of December 31, 2018. Use the adjusted trial balance to prepare Bike World, Inc.?s multistep income statement and statement of retained earnings for the year ending December 31, 2018. Also, prepare the balance sheet at December 31, 2018.

7. Journalize and post the closing entries.

8. Prepare a post-closing trial balance at December 31, 2018.

Balance SheetBalance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer: