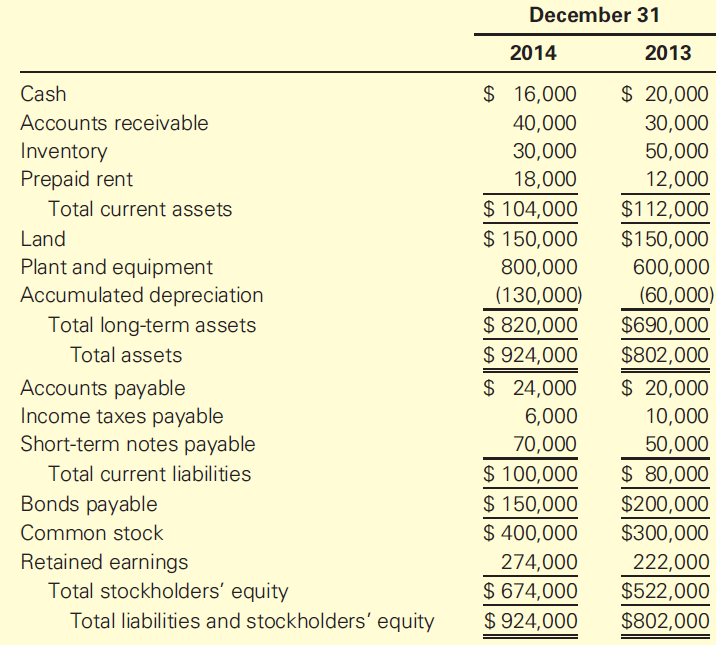

Question: Comparative balance sheets for Farinet Company for the past two years are as follows: Required 1. Using the format in Example 13-4, prepare common-size comparative

Comparative balance sheets for Farinet Company for the past two years are as follows:

Required

1. Using the format in Example 13-4, prepare common-size comparative balance sheets for the two years for Farinet Company.

2. What observations can you make about changes in the relative composition of Farinet€™s accounts from the common-size balance sheets? List at least five observations.

3. Using the format in Example 13-1, prepare comparative balance sheets for Farinet Company, including columns for the dollars and for the percentage increase or decrease in each item on the statement.

4. Identify the five items on the balance sheet that experienced the largest change from one year to the next. For each of these items, explain where you would look to find additional information about the change.

December 31 2014 2013 $ 20,000 $ 16,000 Cash Accounts receivable 40,000 30,000 Inventory Prepaid rent 30,000 50,000 12,000 18,000 $ 104,000 $ 150,000 $112,000 $150,000 Total current assets Land Plant and equipment Accumulated depreciation 800,000 600,000 (130,000) (60,000) $ 820,000 $ 924,000 $ 24,000 Total long-term assets $690,000 Total assets $802,000 $ 20,000 Accounts payable Income taxes payable Short-term notes payable 6,000 10,000 70,000 50,000 $ 100,000 $ 150,000 $ 400,000 $ 80,000 Total current liabilities Bonds payable $200,000 $300,000 Common stock Retained earnings Total stockholders' equity 222,000 $522,000 274,000 $ 674,000 $ 924,000 Total liabilities and stockholders' equity $802,000

Step by Step Solution

3.38 Rating (170 Votes )

There are 3 Steps involved in it

1 Rounded to total 2 Observations from Farinets commonsize balance sheets a Current assets as a percentage of total assets has decreased At the same t... View full answer

Get step-by-step solutions from verified subject matter experts