Cricket Cards Ltd sells boxes of cricket cards. The following information relates to transactions concerning inventory for

Question:

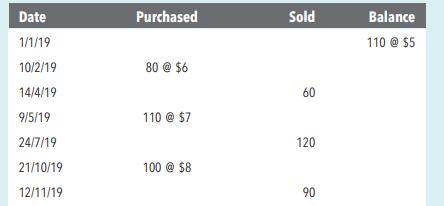

Cricket Cards Ltd sells boxes of cricket cards. The following information relates to transactions concerning inventory for the year 1 January 2019 to 31 December 2019.

(i). Assuming that a perpetual system of inventory flow is used, calculate the COGS and closing inventory for both FIFO and LIFO.

(ii). You estimate that in the current market the net realisable value of cricket cards is $5 per box. Do you need to make any adjustments to either of your calculations above to apply the lower of cost and net realisable value rule? If so, calculate the adjustment.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Accounting An Integrated Approach

ISBN: 9780170411028

7th Edition

Authors: Ken Trotman, Elizabeth Carson

Question Posted: