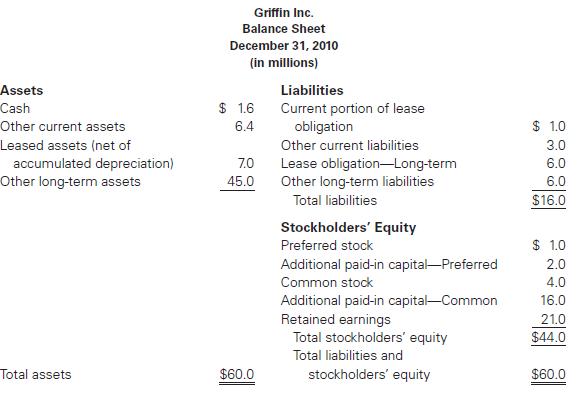

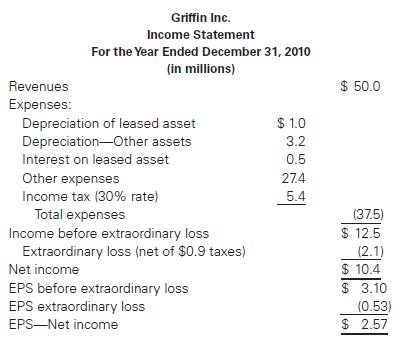

Following are the financial statements for Griffin Inc. for the year 2010: Additional information: Griffin Inc. has

Question:

Following are the financial statements for Griffin Inc. for the year 2010:

Additional information:

Griffin Inc. has authorized 500,000 shares of 10%, $10 par value, cumulative preferred stock. There were 100,000 shares issued and outstanding at all times during 2010. The firm also has authorized 5 million shares of $1 par common stock, with 4 million shares issued and outstanding.

On January 1, 2010, Griffin Inc. acquired an asset, a piece of specialized heavy equipment, for $8 million with a capital lease. The lease contract indicates that the term of the lease is eight years. Payments of $1.5 million are to be made each December 31. The first lease payment was made December 31, 2010, and consisted of $1 million principal and $0.5 million of interest expense. The capital lease is depreciated using the straight-line method over eight years with zero salvage value.

Required

1. Assuming that the equipment was acquired using a capital lease, identify and analyze the effect of the acquisition, depreciation, and lease payment.

2. The management of Griffin Inc. is considering the financial statement impact of methods of financing, other than the capital lease, that could have been used to acquire the equipment. For each alternative (a), (b), and (c), provide all necessary entries, indicate the effect on the accounting equation, and prepare revised 2010 financial statements. Calculate, as revised, the following amounts or ratios:

Current ratio

Debt-to-equity ratio

Net income

EPS—Net income

Assume that the following alternative actions would have taken place on January 1, 2010:

a. Instead of acquiring the equipment with a capital lease, the company negotiated an operating lease to use the asset. The lease requires annual year-end payments of $1.5 million and results in “off-balance-sheet” financing. (Hint: The $1.5 million should be treated as rental expense.)

b. Instead of acquiring the equipment with a capital lease, Griffin Inc. issued bonds for $8 million and purchased the equipment with the proceeds of the bond issue. Assume that the bond interest of $0.5 million was accrued and paid on December 31, 2010. A portion of the principal also is paid each year for eight years. On December 31, 2010, the company paid $1 million of principal and anticipated another $1 million of principal to be paid in 2011. Assume that the equipment would have an eight-year life and would be depreciated on a straight-line basis with zero salvage value.

c. Instead of acquiring the equipment with a capital lease, Griffin Inc. issued 200,000 additional shares of 10% preferred stock to raise $8 million and purchased the equipment for $8 million with the proceeds from the stock issue. Dividends on the stock are declared and paid annually. Assume that a dividend payment was made on December 31, 2010. Assume that the equipment would have an eight-year life and would be depreciated on a straight-line basis with zero salvage value.

Step by Step Answer:

Using Financial Accounting Information The Alternative to Debits and Credits

ISBN: 978-1133161646

7th Edition

Authors: Gary A. Porter, Curtis L. Norton