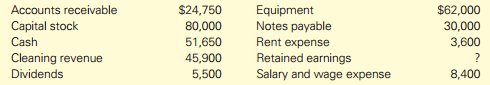

Fort Worth Corporation began business in January 2014 as a commercial carpet-cleaning and drying service. Shares of

Question:

Required

Required1. Prepare an income statement for the month ended January 31, 2014.

2. Prepare a balance sheet at January 31, 2014.

3. What information would you need about Notes Payable to fully assess Fort Worth€™s long-term viability? Explain your answer. Balance Sheet

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Accounting The Impact on Decision Makers

ISBN: 978-1285182964

9th edition

Authors: Gary A. Porter, Curtis L. Norton

Question Posted: