Question: Fortune Software Corp. has assembled the following data for the years ending December 31, 2018 and 2017: Requirement 1. Prepare Fortunes statement of cash flows

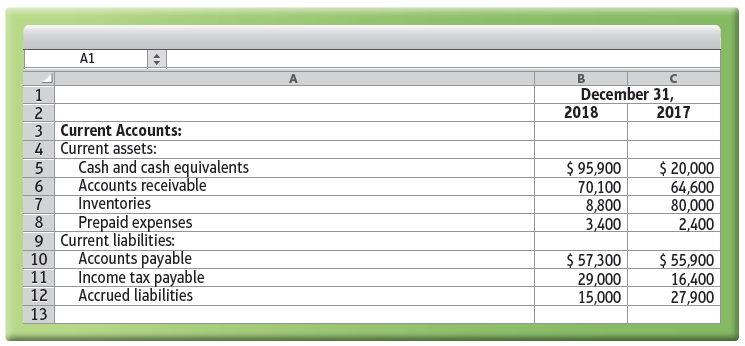

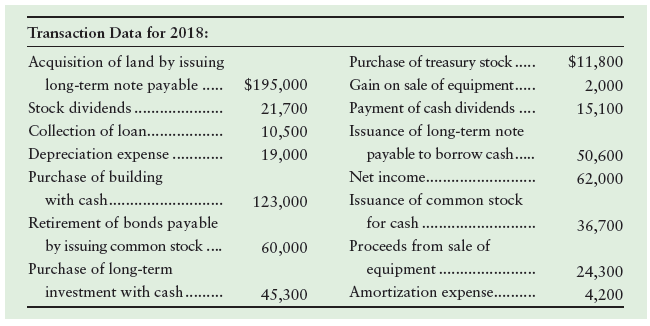

Fortune Software Corp. has assembled the following data for the years ending December 31, 2018 and 2017:

Requirement

1. Prepare Fortune’s statement of cash flows using the indirect method to report operating activities. Include a schedule of noncash investing and financing activities.

A1 December 31, 2018 2017 3 Current Accounts: 4 Current assets: Cash and cash equivalents Accounts receivable $ 95,900 70,100 8,800 3,400 $ 20,000 64,600 80,000 2,400 6. Inventories Prepaid expenses 9 Current liabilities: Accounts payable $ 57,300 29,000 15,000 $ 55,900 16,400 27,900 10 Income tax payable 11 Accrued liabilities 12 13 Transaction Data for 2018: Acquisition of land by issuing Purchase of treasury stock.. Gain on sale of equipment.. $11,800 long-term note payable . $195,000 2,000 Stock dividends . Collection of loan. . Depreciation expense Purchase of building Payment of cash dividends .. Issuance of long-term note 21,700 15,100 .... 10,500 19,000 payable to borrow cash.. 50,600 Net income. 62,000 with cash. 123,000 Issuance of common stock Retirement of bonds payable for cash . 36,700 by issuing common stock .. Purchase of long-term 60,000 Proceeds from sale of equipment 24,300 investment with cash . 45,300 Amortization expense. . 4,200

Step by Step Solution

3.41 Rating (167 Votes )

There are 3 Steps involved in it

Fortune Software Corp Statement of Cash Flows Year Ended December 31 2018 Cash flows from operating ... View full answer

Get step-by-step solutions from verified subject matter experts