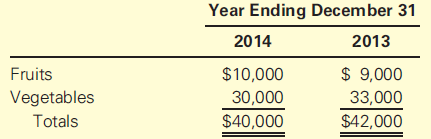

Garden Fresh Inc. is a wholesaler of fresh fruits and vegetables. Each year, it submits a set

Question:

Sales revenue for the year ending December 31, 2014, is $3,690,000. The company€™s gross profit ratio is normally 40%.

Based on these data, the president thinks the company should report an inventory turnover ratio of 90 times per year.

Required

1. Using the necessary calculations, explain how the president came up with an inventory turnover ratio of 90 times.

2. Do you think the company should report a turnover ratio of 90 times? If not, explain why you disagree and explain, with calculations, what you think the ratio should be.

3. Assume that you are the controller for Garden Fresh. What will you tell the president?

Inventory Turnover RatioThe inventory turnover ratio is a ratio of cost of goods sold to its average inventory. It is measured in times with respect to the cost of goods sold in a year normally. Inventory Turnover Ratio FormulaWhere,... Financial Ratios

The term is enough to curl one's hair, conjuring up those complex problems we encountered in high school math that left many of us babbling and frustrated. But when it comes to investing, that need not be the case. In fact, there are ratios that,...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Accounting The Impact on Decision Makers

ISBN: 978-1285182964

9th edition

Authors: Gary A. Porter, Curtis L. Norton

Question Posted: