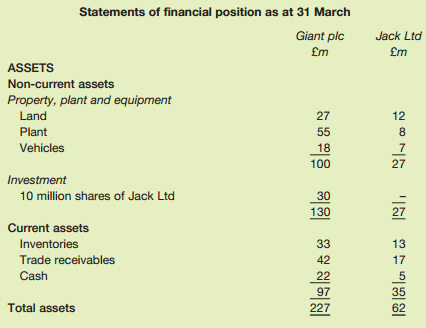

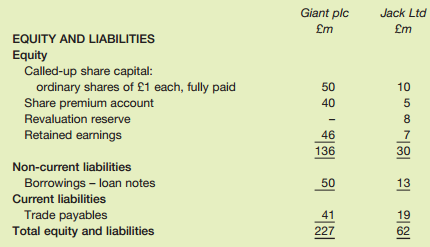

Question: Giant plc bought a majority shareholding in Jack Ltd, on 31 March. On that date the statements of financial position of the two companies were

Required:

Assume that the statement of financial position values of Jack Ltd€™s assets represent €˜fair€™ values. Prepare the group statement of financial position immediately following the takeover.

Statements of financial position as at 31 March Giant plc Jack Ltd m m ASSETS Non-current assets Property, plant and equipment Land 27 12 Plant 55 Vehicles 18 100 27 Investment 10 million shares of Jack Ltd 30 130 27 Current assets Inventories 33 13 Trade receivables 42 17 Cash 22 5 97 35 Total assets 227 62 Giant plc Jack Ltd m m EQUITY AND LIABILITIES Equity Called-up share capital: ordinary shares of 1 each, fully paid Share premium account 50 10 40 5 Revaluation reserve 8. Retained earnings 46 7 136 30 Non-current liabilities Borrowings loan notes 50 13 Current liabilities Trade payables 41 19 Total equity and liabilities 227 62

Step by Step Solution

3.46 Rating (166 Votes )

There are 3 Steps involved in it

Group statement of financial position of Giant and its subsidiary as at 31 March m ASSETS Noncurren... View full answer

Get step-by-step solutions from verified subject matter experts