ICICI Bank Limited 20 and its aggressive growth story in the past decade is a legend. Today

Question:

ICICI Bank Limited20 and its aggressive growth story in the past decade is a legend. Today the firm is the second largest bank in India (next to the State Bank of India). The company provided following information regarding its provisions and contingent liabilities in its annual report for FY2010.

From the Notes to Accounts

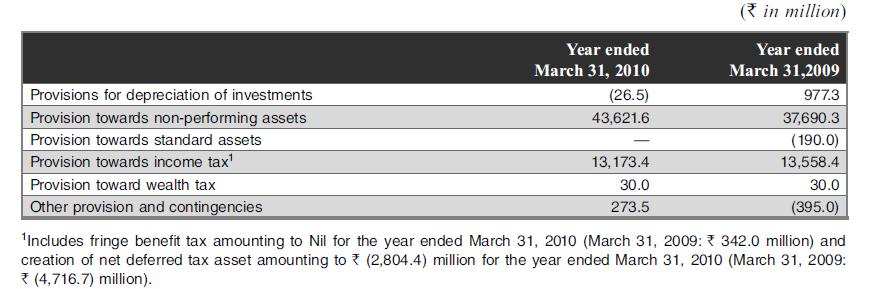

Provisions, contingent liabilities and contingent assets

The Bank estimates the probability of any loss that might be incurred on outcome of contingencies on the basis of information available up to the date on which the financial statements are prepared. A provision is recognised when an enterprise has a present obligation as a result of a past event and it is probable that an outflow of resources will be required to settle the obligation, in respect of which a reliable estimate can be made. Provisions are determined based on management estimates of amounts required to settle the obligation at the balance sheet date, supplemented by experience of similar transactions. These are reviewed at each balance sheet date and adjusted to reflect the current management estimates. In cases where the available information indicates that the loss on the contingency is reasonably possible but the amount of loss cannot be reasonably estimated, a disclosure to this effect is made in the financial statements. In case of remote possibility neither provision nor disclosure is made in the financial statements. The Bank does not account for or disclose contingent assets, if any.

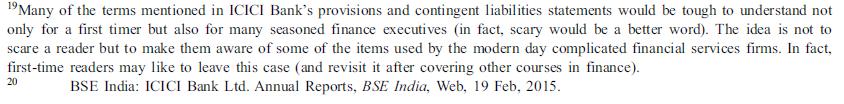

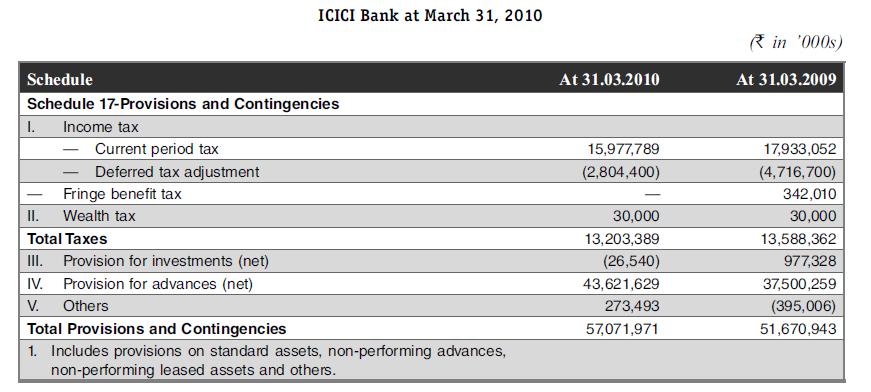

Provisions and contingencies

The following table sets forth, for the periods indicated, the break-up of provisions and contingencies included in profit and loss account.

Case Questions

(a) What are the new jargons you have come across in the above disclosure of the provisions and contingent liabilities? Clarify them.

(b) Discuss the application of the relevant accounting standards on the schedule given.

Step by Step Answer:

Financial Accounting For Management

ISBN: 9789385965661

4th Edition

Authors: Neelakantan Ramachandran, Ram Kumar Kakani