Layne Ltd acquired 90 per cent of the share capital of Beachly Ltd on 1 July 2022

Question:

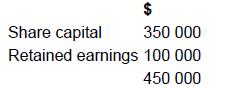

Layne Ltd acquired 90 per cent of the share capital of Beachly Ltd on 1 July 2022 for a cost of $500 000. As at the date of acquisition all assets of Beachly Ltd were fairly valued, other than land that had a carrying amount $50 000 less than its fair value. The recorded balances of equity in Beachly Ltd as at 1 July 2022 were:

Additional information

- The management of Layne Ltd values any non-controlling interest at the proportionate share of Beachly Ltd’s identifiable net assets. Beachly Ltd had a profit after tax of $70 000 for the year ended 30 June 2023.

- During the financial year to 30 June 2023 Beachly Ltd sold inventory to Layne Ltd for a price of $60000. The inventory cost Beachly Ltd $30000 to produce, and 25 per cent of this inventory was still on hand with Layne Ltd as at 30 June 2023.

- During the year Beachly Ltd paid $10 000 in management fees to Layne Ltd.

- On 1 July 2022 Beachly Ltd sold an item of plant to Layne Ltd for $40 000 when it had a carrying amount of $30 000 (cost of $50 000, accumulated depreciation of $20 000). At the date of sale it was expected that the plant had a remaining useful life of four years, and no residual value.

- The tax rate is 30 percent.

REQUIRED

Prepare the consolidation adjustments for the year ended 30 June 2023 and, based on the information provided above, calculate the non-controlling interests in the 2023 profits.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: