Mr. Silkwallah established the Fashion Clothing Company (FCC) to market designer clothes. The business was to get

Question:

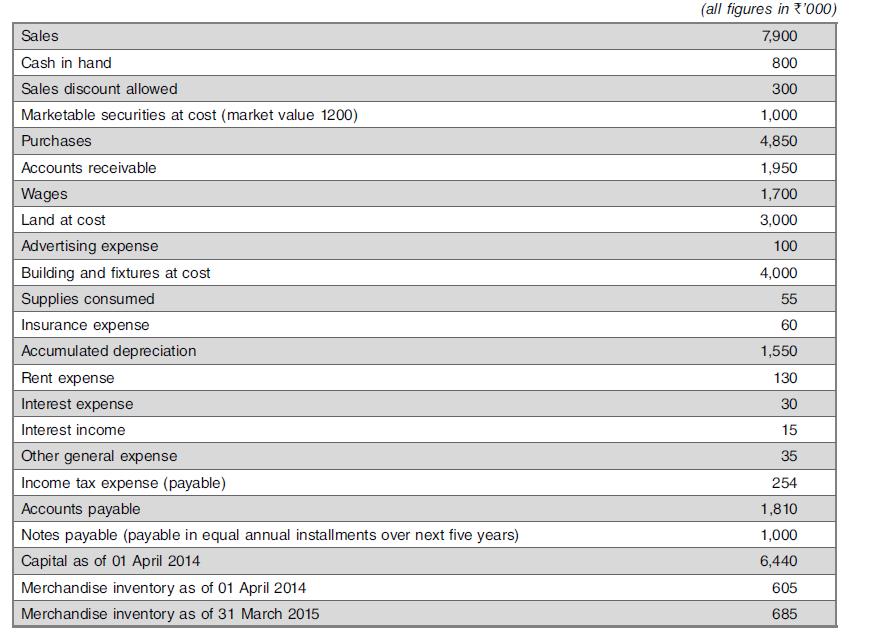

Mr. Silkwallah established the Fashion Clothing Company (FCC) to market designer clothes. The business was to get designer clothes produced by tailors, exclusively for FCC. FCC provides the following information for the year ended as at March 31, 2015:

On 1 April 2015, FCC engaged Ms Kaptawallah as a new design manager, at a monthly salary of ₹45,000, and at her instance, introduced several new designs. FCC purchased ₹1,20,000 worth of new designs, during the quarter beginning April 2015, from a design agency. After Ms Kaptawallah joined FCC, they decided to go in for the manufacture of designer apparel.

FCC obtained a long-term loan of ₹30,00,000 from Small Industries Finance Corporation and a working capital accommodation from the State Bank, in the form of an overdraft limit of 70% of the current assets, against their hypothecation.

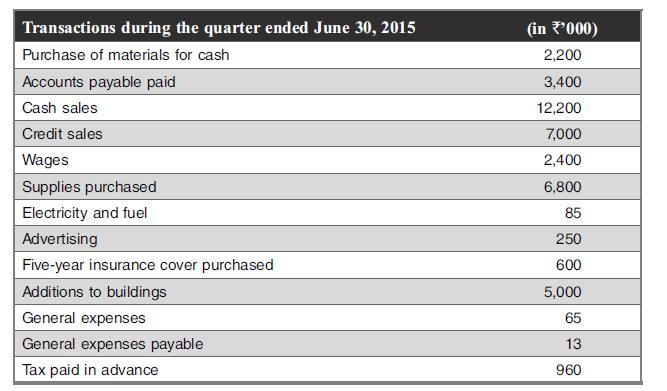

During the quarter ending 30 June 2015, the following transactions were carried out by FCC:

Purchased modern machinery and equipment, including cutting, stitching and finishing machines, at a cost of ₹1,20,00,000, paying ₹20,00,000 down and balance in notes payable to be paid in equal annual installments over the next five years.

On 31 May 2015, Mr. Silkwallah, owner of FCC, married Ms Kaptawallah and she was admitted as a partner in FCC with a 50% share of profits. She brought in ₹50,00,000 towards the capital of FCC.

Dresses worth ₹250,000 at list price, were given to Ms Kaptawallah as gifts at the time of marriage, from the business inventory. However, this was not included as sales during the year. All the marketable securities were sold during the quarter for ₹1,200,000.

As on 30 June 2015: accounts receivable stood at ₹13,50,000; accounts payable stood at ₹8,50,000; finished goods inventory at ₹8,35,000; Inventory of materials at ₹40,000; supplies at ₹18,00,000; work in progress at ₹9,85,000.

Wages paid during the first quarter, ending 30 June 2015, included ₹1,00,000 paid as advance to the workers. The advance will be repaid during the next quarter.

Buildings and fixtures are depreciated at the rate of 2.5% per annum on a straight-line basis; while machinery and equipment is depreciated at the rate of 25% per annum on a written down value basis. Cost of designs is expired during the year of acquisition.

The tax rate applicable to the business is 40% of net profit.

A long-term loan was obtained on 1 April 2015, and it carries an interest of 12% per annum, to be paid during the first quarter of the next fiscal year. Overdraft carries an interest of 15% per annum, charged on the average of high and low balances during the quarter, for the whole year.

1. Prepare a profit and loss account for the periods ending 31 March 2015, and 30 June 2015 and the balance sheets as of those dates.

2. Comment on the performance of the business.

3. Comment on Ms Kaptawallah’s decision to invest in the business.

Step by Step Answer:

Financial Accounting For Management

ISBN: 9789385965661

4th Edition

Authors: Neelakantan Ramachandran, Ram Kumar Kakani