On 1st April, 2011, Dickins Limited (DL) acquired the business of Ceepee Limited (CL) by acquiring all

Question:

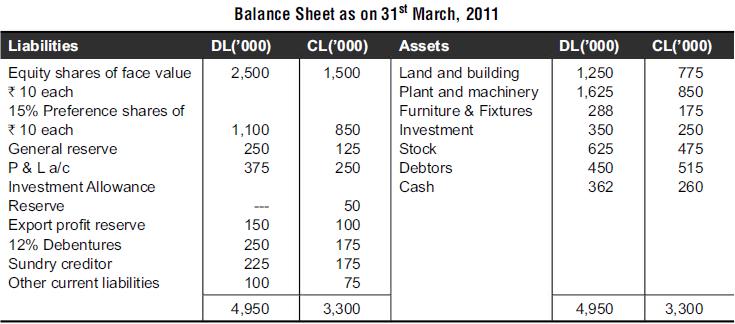

On 1st April, 2011, Dickins Limited (DL) acquired the business of Ceepee Limited (CL) by acquiring all the assets and liabilities at the book value it agreed to discharge the purchase consideration as follows:

(i) To issue 1,75,000 equity shares of face value of ₹10 each to the equity shareholders of CL

ii) To issue requisite number of 10% preference shares of ₹10 at par so as to redeem 15% preference shares of CL at a premium of 10%

Show how purchase consideration will be calculated if it is

(i) amalgamation in the nature of merger and

(ii) amalgamation in the nature of purchase.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: