On December 31, 2017, Mica Company prepared a statement of earnings and a statement of financial position

Question:

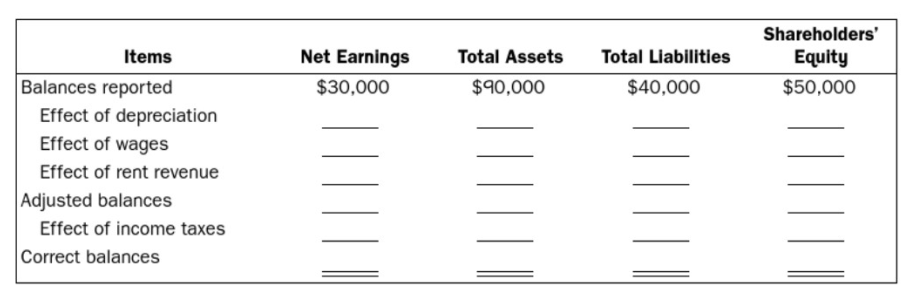

On December 31, 2017, Mica Company prepared a statement of earnings and a statement of financial position but failed to take into account four adjusting entiies. The statement of earnings, prepared on this incorrect basis, reflected pretax earnings of $30,000. The statement of financial position (before the effect of income taxes) reflected total assets, $90,000; total liabilities, $40,000; and shareholders' equity, $50,000. The data for the four adjusting entries follow:a. Depreciation of $9,000 for the year on equipment that cost $75,000 was not recorded.b. Wages accounting to $17,000 for the last three days of December 2017 were not paid and not recorded (the next pay date is January 10, 2018).c. An amount of $9,600 was collected on December 1, 2017, for rental of office space for the period December 1, 2017, to February 28, 2018. The $9,600 was credited in full to deferred rent revenuewhen?collected.d. Income taxes were not recorded. The income tax rate for the company is 30 percent.

Required:Complete the fallowing tabulation to correct the financial statements for the effects of the four errors (indicate deductions with parentheses):

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer:

Financial Accounting

ISBN: 978-1259105692

6th Canadian edition

Authors: Robert Libby, Patricia Libby, Daniel G Short, George Kanaan, Maureen Sterling