Peter Company purchases a machine during 2020 for $120,000. The machine is being depreciated on a straight-line

Question:

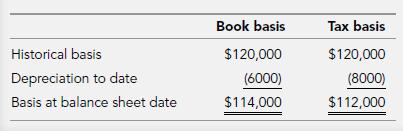

Peter Company purchases a machine during 2020 for $120,000. The machine is being depreciated on a straight-line basis over 20 years for financial accounting purposes (book) and over 15 years for tax purposes. At the end of 2020, depreciation expense for book purposes is $6,000 and for tax purposes is $8,000.

Required:

Should a temporary difference be recorded?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Accounting Theory And Analysis Text And Cases

ISBN: 9781119577775

13th Edition

Authors: Richard G Schroeder, Myrtle W Clark, Jack M Cathey

Question Posted: