Precision Corporation was organized on January 1, 2021. At the end of 2021, the company had not

Question:

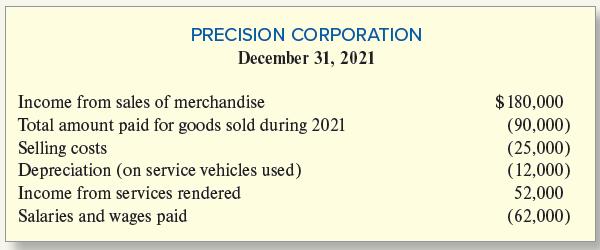

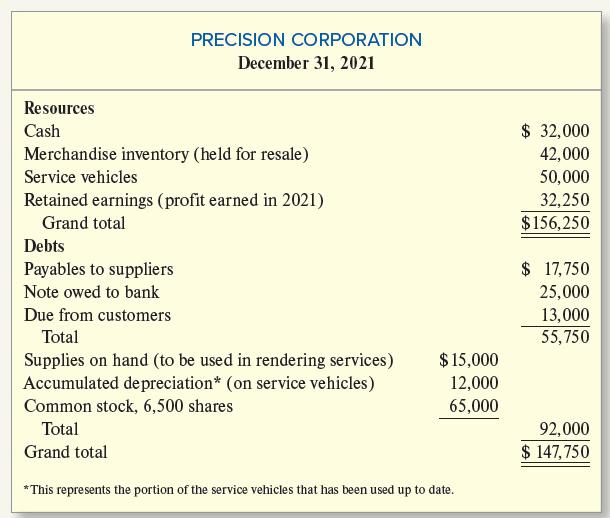

Precision Corporation was organized on January 1, 2021. At the end of 2021, the company had not yet employed an accountant; however, an employee who was “good with numbers” prepared the following statements at that date:

Required:

1. List all deficiencies that you can identify in these statements. Give a brief explanation of each one.

2. Prepare a proper income statement (correct net income is $32,250 and income tax expense is $10,750) and balance sheet (correct total assets are $140,000).

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Accounting

ISBN: 9781264229734

11th Edition

Authors: Robert Libby, Patricia Libby, Frank Hodge

Question Posted: