Refer to AP3-7. Data From in AP3-7 Waterfun Park, Inc., is a large regional waterpark operator in

Question:

Refer to AP3-7.

Data From in AP3-7

Waterfun Park, Inc., is a large regional waterpark operator in the southern United States. The following are summarized transactions similar to those that occurred in a recent year. Dollars are in thousands.

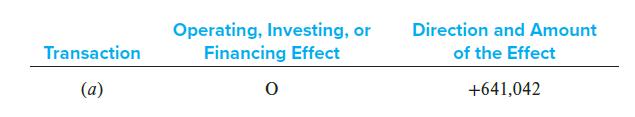

a. Guests at the parks paid $641,042 cash in admissions.

b. Waterfun Park paid $49,800 principal on long-term notes payable.

c. Waterfun Park purchased and built additional water rides and other equipment during the year, paying $98,290 in cash.

d. Guests may stay in the parks at accommodations owned by the company. During the year, accommodations revenue was $90,194; $88,605 was paid by the guests in cash and the rest was owed on account.

e. The primary operating expenses for the year were employee wages of $469,416, with $437,630 paid in cash and the rest to be paid to employees in the following year.

f. The park sells merchandise in park stores. The cash received during the year for sales was $401,693.

g. The cost of the merchandise inventory sold during the year was $101,057.

h. Interest incurred and paid on long-term debt was $171,326.

i. The company purchased $161,031 in inventory for the park stores during the year, paying $130,231 in cash and owing the rest on account.

j. Waterfun Park paid $13,400 on accounts payable during the year.

k. Advertising costs for the parks were $153,926 for the year; $143,944 was paid in cash and the rest was owed on account.

Required:

For the transactions listed in AP3-7, use the following chart to identify whether each transaction results in a cash flow effect from operating (O), investing (I), or financing (F) activities and indicate the direction and amount of the effect on cash (+ for increase and − for decrease). If there is no cash flow effect, write NE in each column. The first transaction is provided as an example.

Step by Step Answer:

Financial Accounting

ISBN: 9781264229734

11th Edition

Authors: Robert Libby, Patricia Libby, Frank Hodge