Refer to the data in exercise 12.6. Assume that the firm is registered for the GST, i.e.

Question:

Refer to the data in exercise 12.6. Assume that the firm is registered for the GST, i.e. consulting fees owing will be $517 000 (including GST) and debts to be written off are $10 010 (including GST).

Data From in exercise 12.6

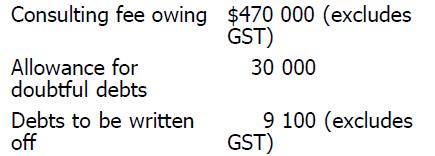

The following details were obtained from the accounting records of Civil Construction Consultants at the end of the financial year.

The firm requires an allowance for doubtful debts of 10% of outstanding fees at 30 June. Ignore GST.

Required

A. Prepare the appropriate general journal entries.

B. Prepare and balance the Allowance for Doubtful Debts account at 30 June 2015.

C. Show the amount(s) to be charged as bad debts expense for the year.

Step by Step Answer:

Financial Accounting

ISBN: 9781118608203

9th Edition

Authors: John Hoggett, Lew Edwards, John Medlin, Keryn Chalmers, Jodie Maxfield, Andreas Hellmann, Claire Beattie