Refer to the information in E519, but now assume that the balance of the Allowance for Uncollectible

Question:

Refer to the information in E5–19, but now assume that the balance of the Allowance for Uncollectible Accounts on December 31, 2021, is $1,100 (debit) (before adjustment).

Required:

1. Record the adjustment for uncollectible accounts using the percentage-of-receivables method. Suzuki estimates 12% of receivables will not be collected.

2. Record the adjustment for uncollectible accounts using the percentage-of-credit-sales method. Suzuki estimates 3% of credit sales will not be collected.

3. Calculate the effect on net income (before taxes) and total assets in 2021 for each method.

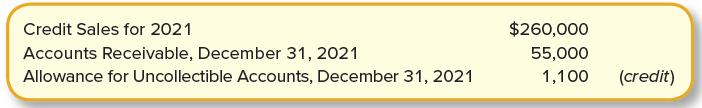

E5-19

Suzuki Supply reports the following amounts at the end of 2021 (before adjustment).

Step by Step Answer:

Financial Accounting

ISBN: 978-1259914898

5th edition

Authors: David Spiceland, Wayne M. Thomas, Don Herrmann