Refer to the information regarding Bills Catering Company in AP4-3. Data From in AP4-3 Bills Catering Company

Question:

Refer to the information regarding Bill’s Catering Company in AP4-3.

Data From in AP4-3

Bill’s Catering Company is at its accounting year-end on December 31. The following data that must be considered were developed from the company’s records and related documents:

a. During the current year, office supplies amounting to $1,200 were purchased for cash and debited in full to Supplies. At the beginning of the year, the count of supplies on hand was $450; at the end of the year, the count of supplies on hand was $400.

b. On December 31 of the current year, the company catered an evening gala for a local celebrity. The $7,440 bill is due from the customer by the end of January of next year. No cash has been collected, and no journal entry has been made for this transaction.

c. On October 1 of the current year, a one-year insurance premium on equipment in the amount of $1,200 was paid and debited in full to Prepaid Insurance on that date. Coverage began on November 1 of the current year.

d. On December 31 of the current year, repairs on one of the company’s delivery vans were completed at a cost estimate of $600; the amount has not yet been paid or recorded by Bill’s. The repair shop will bill Bill’s Catering at the beginning of January of next year.

e. In November of the current year, Bill’s Catering signed a lease for a new retail location, providing a down payment of $2,100 for the first three months’ rent that was debited in full to Prepaid Rent. The lease began on December 1 of the current year.

f. On July 1 of the current year, the company purchased new refrigerated display counters at a cash cost of $18,000. Depreciation of $2,570 has not been recorded for the current year.

g. On November 1 of the current year, the company loaned $4,000 to one of its employees on a one-year, 12 percent note. The principal plus interest is payable by the employee at the end of 12 months.

h. The income before any of the adjustments or income taxes was $22,400. The company’s income tax rate is 25 percent.

Required:

1. Indicate whether each transaction relates to a deferred revenue, deferred expense, accrued revenue, or accrued expense.

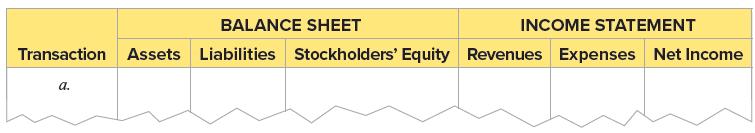

2. Using the following headings, indicate the effect of each adjusting entry and the amount of each. Use + for increase, − for decrease, and NE for no effect. (Reminder: Assets = Liabilities + Stockholders’ Equity; Revenues − Expenses = Net Income; and Net Income accounts are closed to Retained Earnings, a part of Stockholders’ Equity.)

Step by Step Answer:

Financial Accounting

ISBN: 9781264229734

11th Edition

Authors: Robert Libby, Patricia Libby, Frank Hodge