Question: Software Ltd is a software technology company that began operations at the beginning of 2017. It plans to list on the Australian Stock Exchange in

Software Ltd is a software technology company that began operations at the beginning of 2017. It plans to list on the Australian Stock Exchange in 2019. The company believes that it can start selling its software program from 2018 (sales forecasts are in the income statement below).

The software program is to be sold and delivered (i.e. downloaded) via the internet, thus allowing the company to avoid product sales and delivery costs. The company needs to carry out research and development activities throughout its life cycle to keep up with ever-changing computer technologies. The following schedule provides the expected expenditure on research and development.

The company’s current accounting policy for research and development costs is as follows:

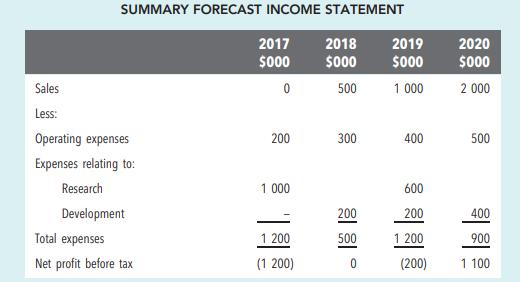

The summary forecast income statement is as follows:

The CFO notices that as the company is expected to make a loss in 2019, it would be difficult to go for a public listing in 2019. He is considering the accounting policy on research and development costs as follows: research costs expected to be incurred in 2019 and onwards will be capitalised and amortised over three years, and development costs expected to be incurred in 2018 and onwards will be immediately expensed.

1. Recalculate the summary forecast income statement to reflect the change in accounting policy for research and development.

2. Explain why the CFO may want this change.

3. Would the above change be consistent with Australian Accounting Standards?

4. Discuss the cash flow implications of the proposed accounting policy changes for the year 2018 only.

Expected expenditure: Research Development 2017 $000 1 000 2018 $000 600 2019 $000 600 2020 $000 600

Step by Step Solution

3.37 Rating (147 Votes )

There are 3 Steps involved in it

1 Recalculated Summary Forecast Income Statement To recalculate the summary forecast income statement we need to adjust the accounting treatment for r... View full answer

Get step-by-step solutions from verified subject matter experts