The following information about the payroll for the week ended December 30 was obtained from the records

Question:

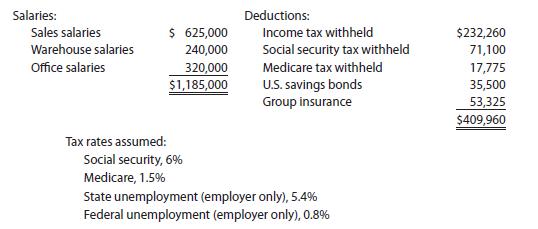

The following information about the payroll for the week ended December 30 was obtained from the records of Saine Co.:

Instructions

1. Assuming that the payroll for the last week of the year is to be paid on December 31, journalize the following entries:

a. December 30, to record the payroll.

b. December 30, to record the employer’s payroll taxes on the payroll to be paid on December 31. Of the total payroll for the last week of the year, $30,000 is subject to unemployment compensation taxes.

2. Assuming that the payroll for the last week of the year is to be paid on January 4 of the following fiscal year, journalize the following entries:

a. December 30, to record the payroll.

b. January 4, to record the employer’s payroll taxes on the payroll to be paid on January 4. Because it is a new fiscal year, all $1,185,000 in salaries is subject to unemployment compensation taxes.

Step by Step Answer:

Financial Accounting

ISBN: 978-1305088436

14th edition

Authors: Carl S. Warren, Jim Reeve, Jonathan Duchac