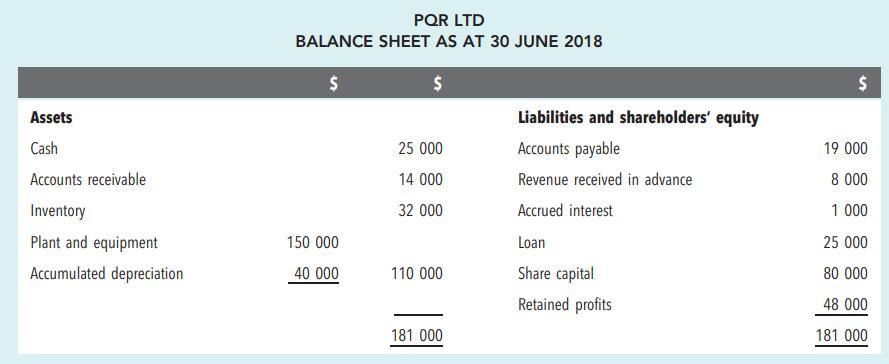

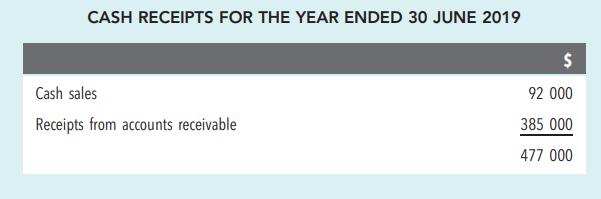

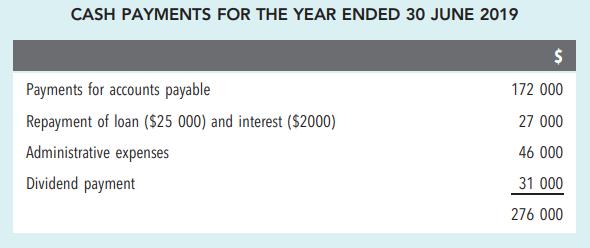

The following information has been extracted from the accounts of PQR Ltd. Additional information: a. Balances as

Question:

The following information has been extracted from the accounts of PQR Ltd.

Additional information:

a. Balances as at 30 June 2019:

b. Credit purchases of inventory totalled $176 000 for the year.

c. The services relating to the revenue received in advance at 30 June 2018 were provided during the year.

d. No additions or disposals of plant and equipment were made during the period. The depreciation rate is 20 per cent per annum. The straight-line method is used.

e. Administrative expenses included a prepayment of $4000 for July 2019.

f. Accrued interest on 30 June 2018 related to the loan which was repaid during the year. There is no accrued interest as at 30 June 2019.

Required:

1. Calculate total revenue for the year ended 30 June 2019.

2. List all expenses for the year (including dollar amounts).

3. Calculate the balance of cash as at 30 June 2019. 4 Provide a balance sheet as at 30 June 2019.

Step by Step Answer:

Financial Accounting An Integrated Approach

ISBN: 9780170411028

7th Edition

Authors: Ken Trotman, Elizabeth Carson