Question: The income statement for Pluto Inc. for 2014 is as follows: For the Year Ended December 31, 2014 Sales revenue .......................................................$350,000 Cost of goods sold

The income statement for Pluto Inc. for 2014 is as follows:

For the Year Ended

December 31, 2014

Sales revenue .......................................................$350,000

Cost of goods sold .................................................150,000

Gross profit ..........................................................$200,000

Operating expenses ..............................................250,000

Loss before interest and taxes ..........................$ (50,000)

Interest expense .......................................................10,000

Net loss .................................................................$ (60,000)

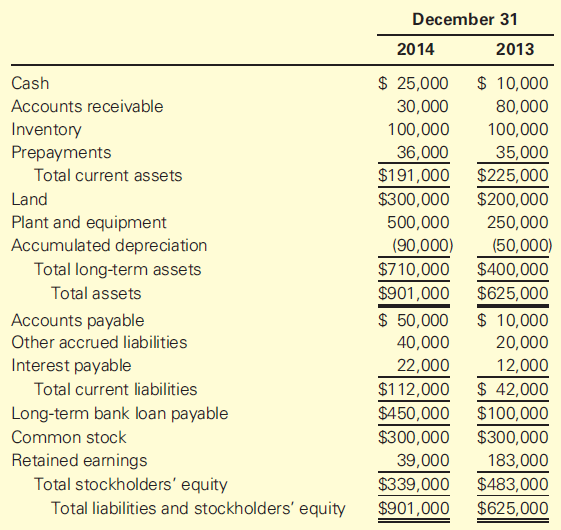

Presented here are comparative balance sheets:

Other information is as follows:

a. Dividends of $84,000 were declared and paid during the year.

b. Operating expenses include $40,000 of depreciation.

c. Land and plant and equipment were acquired for cash. Cash was received from additional bank loans.

The president has asked you some questions about the year€™s results. He is disturbed with the net loss of $60,000 for the year. He notes, however, that the cash position at the end of the year is improved. He is confused about what appear to be conflicting signals: €˜€˜How could we have possibly added to our bank accounts during such a terrible year of operations?€™€™

Required

1. Prepare a statement of cash flows for 2014 using the direct method in the Operating Activities section.

2. On the basis of your statement in part (1), draft a brief memo to the president to explain why cash increased during such an unprofitable year. Include in your memo your recommendations for improving the company€™s bottom line.

December 31 2014 2013 $ 25,000 $ 10,000 Cash Accounts receivable 30,000 80,000 Inventory Prepayments 100,000 100,000 36,000 35,000 $225,000 Total current assets $191,000 Land $300,000 $200,000 Plant and equipment Accumulated depreciation Total long-term assets 250,000 500,000 (90,000) $710,000 (50,000) $400,000 Total assets $901,000 $625,000 $ 50,000 $ 10,000 Accounts payable Other accrued liabilities 40,000 20,000 Interest payable 22,000 $112,000 12,000 $ 42,000 Total current liabilities $450,000 $100,000 Long-term bank loan payable $300,000 Common stock $300,000 Retained earnings Total stockholders' equity 39,000 183,000 $339,000 $483,000 Total liabilities and stockholders' equity $901,000 $625,000

Step by Step Solution

3.41 Rating (182 Votes )

There are 3 Steps involved in it

1 Changes in account balances and explanations in thousands of dollars Net Change Dr Cr Explanation Cash 15 Accounts receivable 50 Inventory 0 Prepayments 1 Land 100 Purchase c Plant and equipment 250 ... View full answer

Get step-by-step solutions from verified subject matter experts