Question: This case involves making use of your roll number and your date of birth. Share prices of Lamb & Tiger (L&T) in the recent past

This case involves making use of your roll number and your date of birth.

Share prices of Lamb & Tiger (L&T) in the recent past are under pressure, primarily because of lack of growth in the profit figures of the company. Top bosses in the firm including its CEO were quite unhappy about this and were under tremendous pressure.

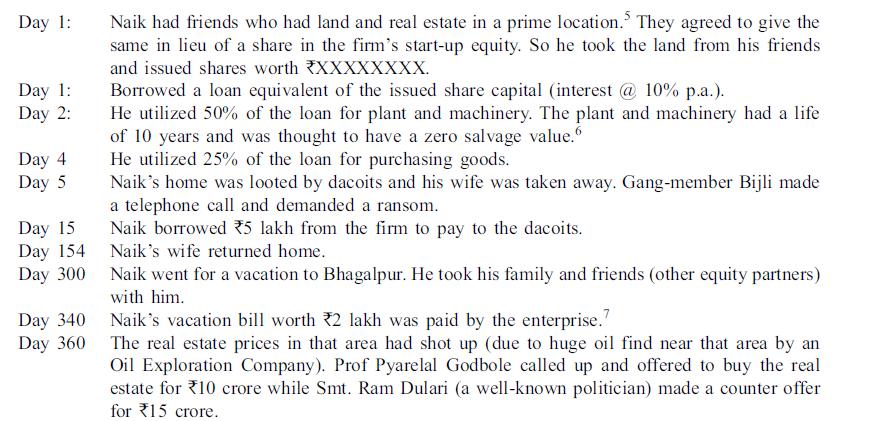

Worried about his reputation, the CEO of L&T, Naik decided to call it a day and start on his own. He names his little enterprise as Mandodari Enterprises Private Limited. The firm under the leadership of Naik went in for the following transactions for his business entity:

During the year the firm made (only) cash sales to the extent ₹167 lakh. The firm also paid salary to its employees totaling ₹2 lakh. There were other expenses to the extent of ₹2 lakh paid by cash. There was no stock left at the end of the year. The firm has to make a provision for tax payment. The corporate tax rate is 40%.

Unfortunately, Naik did not have a hang of accounting – hence, he calls you on your dabba8 and asks you to help him in finalizing the firm’s financial statements ending 31 March 2011. Based on the above discussion, please answer the following multiple choice questions:

1. The provision for corporate income tax of Mandodari Enterprises Private Limited would be

(a) Negative

(b) Positive, above ₹3 million

(c) Positive, below ₹3 million

(d) None of the above

2. The Networth of Mandodari Enterprises Private Limited would be

(a) Negative

(b) Positive, above ₹3 million

(c) Positive, below ₹3 million

(d) None of the above

3. The Cash Balance of Mandodari Enterprises Private Limited would be

(a) Negative

(b) Positive, above ₹50 million

(c) Positive, below ₹50 million

(d) Can’t say

4. In the Funds Flow Statement, the Funds from Operations of Mandodari Enterprises Private Limited would be

(a) Negative

(b) Positive, above ₹3 million

(c) Positive, below ₹3 million

(d) None of the above

5. In the Statement of Cash Flow, the “Cash from Investing Activities” of Mandodari Enterprises Private Limited would be

(a) Negative

(b) Positive, above ₹30 million

(c) Positive, below ₹30 million

(d) None of the above

6. In the Statement of Cash Flow, the “Cash from Financing Activities” of Mandodari Enterprises Private Limited would be

(a) Negative and odd number

(b) Positive and odd number

(c) Positive and even number

(d) None of the above

7. In the Funds Flow Statement, the “Change in Working Capital” of Mandodari Enterprises Private Limited would be

(a) Negative and odd number

(b) Positive and odd number

(c) Positive and even number

(d) None of the above

8. In the Balance Sheet, the “Other Assets” of Mandodari Enterprises Private Limited would be

(a) Negative and Odd Number

(b) Positive and Odd Number

(c) Positive and Even Number

(d) None of the above

9. At the end of the financial year, based on the above limited information, one can state that the Financial Health of the company is

(a) Good

(b) Bad

(c) Can’t say

10. If Naik had agreed to Smt. Ram Dulari’s proposal over phone (on day 360) then the financial statements being prepared would change:

(a) Yes

(b) No

(c) Can’t say

Day 1: Naik started his business by investing cash worth *XXX XXXX4 (by issuing equity shares to himself) on 1 April 2010.

Step by Step Solution

3.42 Rating (152 Votes )

There are 3 Steps involved in it

To answer the multiplechoice questions we will need to piece together information from the narrative and the images However you have not provided me with specific numerical values such as your date of ... View full answer

Get step-by-step solutions from verified subject matter experts