Question: This case will help you learn to use a companys inventory notes. The notes are part of the financial statements. They give details that would

This case will help you learn to use a company’s inventory notes. The notes are part of the financial statements. They give details that would clutter the financial statements themselves. Refer to Apple Inc.’s consolidated financial statements and related notes in Appendix A and online in the filings section of www.sec.gov and answer the following questions:

Requirements

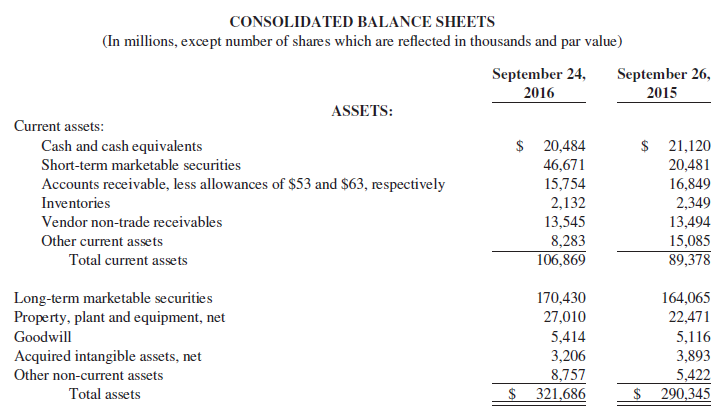

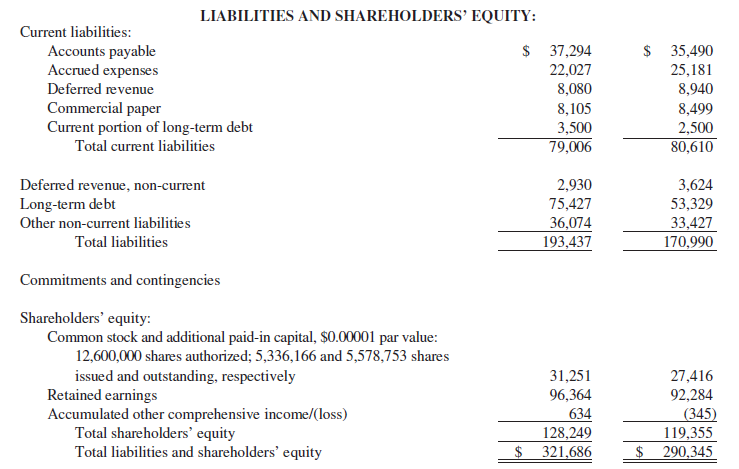

1. How much was Apple’s merchandise inventory at September 24, 2016? At September 26, 2015? Does Apple include all inventory that it handles in the inventory account on its balance sheet?

2. Refer to Note 1, Summary of Significant Accounting Policies, Inventories section. How does Apple value its inventories? Which cost method does the company use?

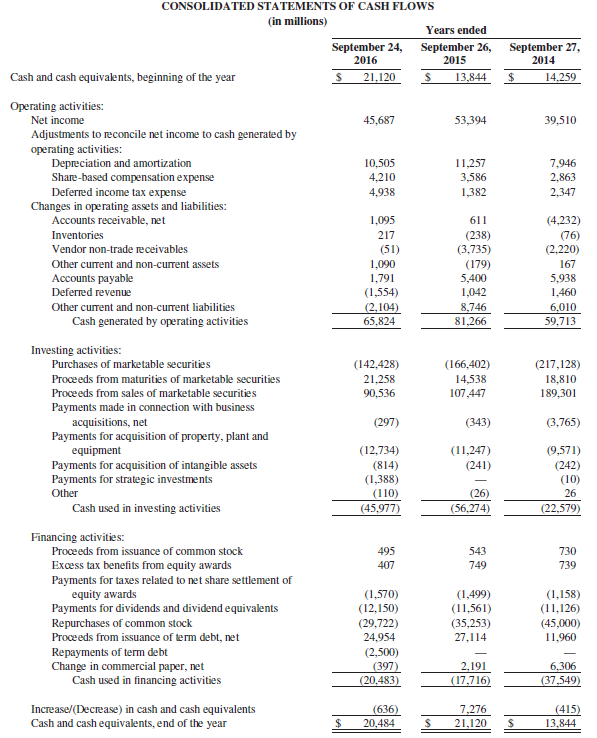

3. Using the cost-of-goods-sold model, compute Apple’s purchases of inventory during the year ended September 24, 2016.

4. Did Apple’s gross profit percentage on company sales improve or deteriorate in the year ended September 24, 2016, compared to the previous year?

5. Assume that ending inventory on September 27, 2014, was $2,111 million. (Remember that the ending inventory in one period becomes the beginning inventory in the next period.) Compute Apple’s inventory turnover for 2016 and 2015. Is Apple’s rate of inventory turnover for the years ended September 24, 2016, and September 26, 2015, fast or slow compared to most other companies in its industry? Explain your answer.

6. Go to the SEC’s website (www.sec.gov). Find Apple’s consolidated balance sheet and consolidated statement of operations for the fiscal year ended September 30, 2017. What has happened to the company’s inventory turnover and gross profit percentages since September 24, 2016? Why have they changed? Where would you find the company’s explanations for the changes? (Challenge)

Data from Apple Inc.'s

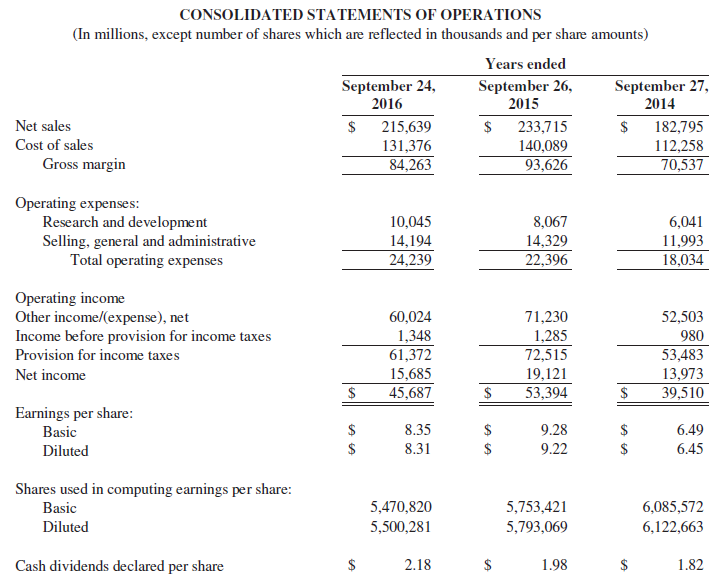

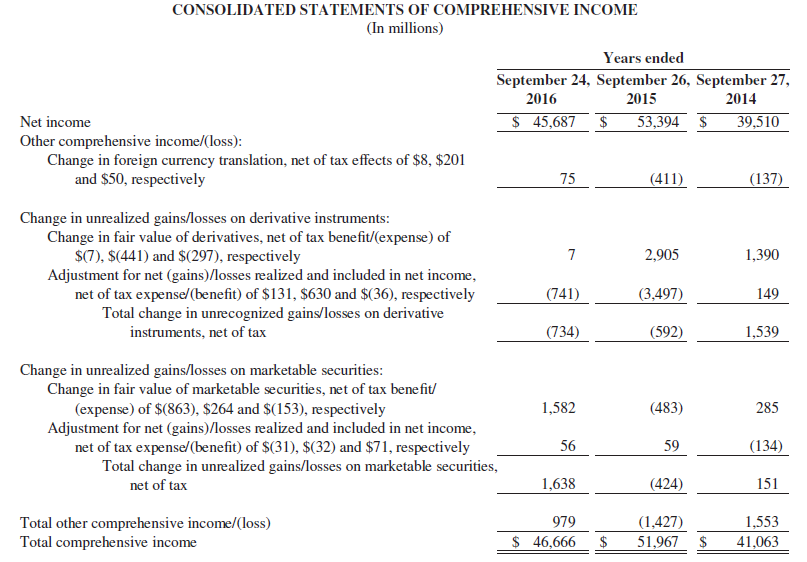

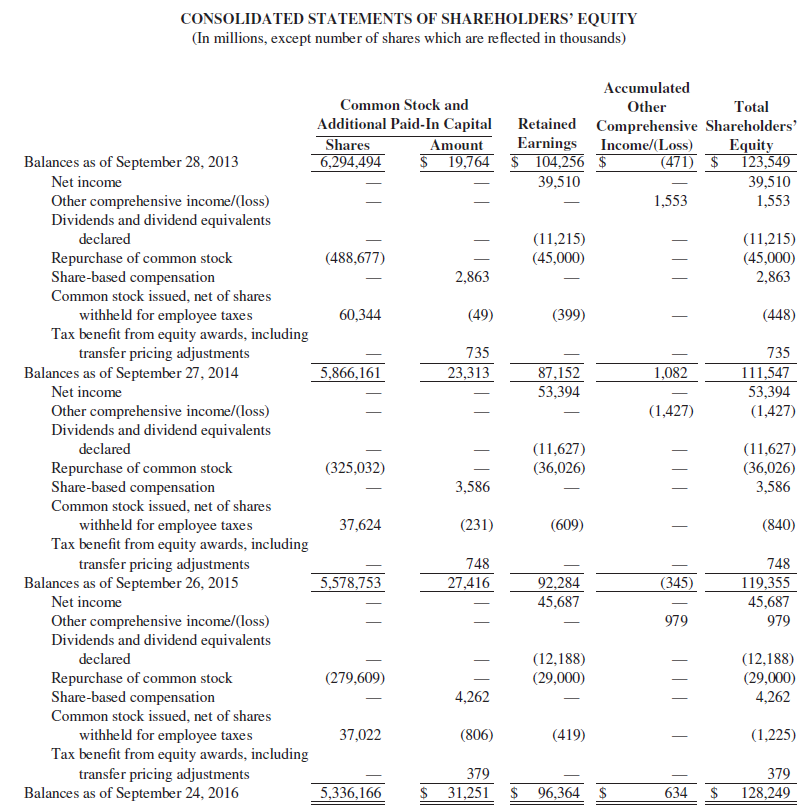

CONSOLIDATED STATEMENTS OF OPERATIONS (In millions, except number of shares which are reflected in thousands and per share amounts) Years ended September 26, 2015 September 24, 2016 September 27, 2014 Net sales 215,639 131,376 84,263 233,715 140,089 93,626 182,795 Cost of sales 112,258 70,537 Gross margin Operating expenses: Research and development Selling, general and administrative Total operating expenses 6,041 10,045 14,194 24,239 8,067 14,329 22,396 11,993 18,034 Operating income Other income/(expense), net Income before provision for income taxes 60,024 1,348 61,372 71,230 1,285 72,515 52,503 980 53,483 Provision for income taxes 19,121 15,685 45,687 13,973 Net income 53,394 39,510 Earnings per share: Basic 2$ 8.35 9.28 6.49 8.31 9.22 6.45 Diluted Shares used in computing earnings per share: Basic 5,470,820 5,753,421 6,085,572 5,500,281 Diluted 5,793,069 6,122,663 Cash dividends declared per share 2.18 1.98 1.82 %24 CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (In millions) Years ended September 24, September 26, September 27, 2016 2015 2014 Net income $ 45,687 53,394 $ 39,510 Other comprehensive income/(loss): Change in foreign currency translation, net of tax effects of $8, $201 and $50, respectively 75 (411) (137) Change in unrealized gains/losses on derivative instruments: Change in fair value of derivatives, net of tax benefit/(expense) of $7), $(441) and $(297), respectively Adjustment for net (gains)/losses realized and included in net income, net of tax expense/(benefit) of $131, $630 and $(36), respectively Total change in unrecognized gains/losses on derivative 2,905 1,390 (741) (3,497) 149 instruments, net of tax (734) (592) 1,539 Change in unrealized gains/losses on marketable securities: Change in fair value of marketable securities, net of tax benefit/ (expense) of $(863), $264 and $(153), respectively Adjustment for net (gains)/losses realized and included in net income, net of tax expense/(benefit) of $(31), $(32) and $71, respectively Total change in unrealized gains/losses on marketable securities, 1,582 (483) 285 56 59 (134) net of tax 1,638 (424) 151 979 (1,427) 1,553 Total other comprehensive income/(loss) Total comprehensive income $ 46,666 51,967 $ 41,063

Step by Step Solution

3.49 Rating (159 Votes )

There are 3 Steps involved in it

Req 1 Apple Inc reports all of its inventory on the balance sheetNote 1 of the Consolidated Financia... View full answer

Get step-by-step solutions from verified subject matter experts