Togos Sandwich Shop had the following long-term asset balances as of January 1, 2021: Togos purchased all

Question:

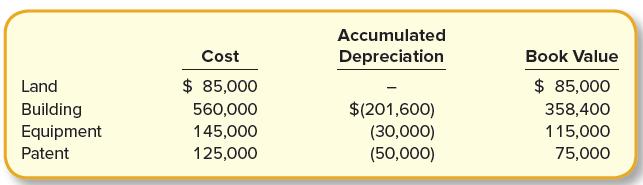

Togo’s Sandwich Shop had the following long-term asset balances as of January 1, 2021:

Togo’s purchased all the assets at the beginning of 2019 (3 years ago). The building is depreciated over a 10-year service life using the double-declining-balance method and estimating no residual value. The equipment is depreciated over a nine-year useful life using the straight-line method with an estimated residual value of $10,000. The patent is estimated to have a five-year service life with no residual value and is amortized using the straight-line method. Depreciation and amortization have been recorded for 2019 and 2020.

Required:

1. For the year ended December 31, 2021, record depreciation expense for buildings and equipment. Land is not depreciated.

2. For the year ended December 31, 2021, record amortization expense for the patent.

3. Calculate the book value for each of the four long-term assets at December 31, 2021.

Step by Step Answer:

Financial Accounting

ISBN: 978-1259914898

5th edition

Authors: David Spiceland, Wayne M. Thomas, Don Herrmann