Question: Use the partial information given in Leslies electronic W-2 form (see question 3) to calculate the amount in Box 1. 1545-0008 Safe, accurate, FAST! Use

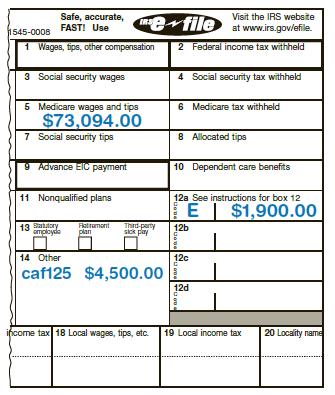

Use the partial information given in Leslie’s electronic W-2 form (see question 3) to calculate the amount in Box 1.

1545-0008 Safe, accurate, FAST! Use 1 Wages, tips, other compensation 3 Social security wages 5 Medicare wages and tips $73,094.00 7 Social security tips 9 Advance EIC payment 11 Nonqualified plans 13 Statutory amployde e file Flatromont Third-party plan sick pay income tax 18 Local wages, tips, etc. Visit the IRS website at www.irs.gov/efile. 2 Federal income tax withheld 4 Social security tax withheld onuose uoua 6 Medicare tax withheld 8 Allocated tips 10 Dependent care benefits 12a See instructions for box 12 E $1,900.00 12b 12c 14 Other caf125 $4,500.00 B 12d 19 Local income tax 20 Locality name

Step by Step Solution

3.55 Rating (159 Votes )

There are 3 Steps involved in it

Without knowing the specific information in Leslies electronic W2 form we cannot provide an exact ca... View full answer

Get step-by-step solutions from verified subject matter experts