Highways End produces energy drinks that are sold in convenience stores and at rest stops along major

Question:

Highways End produces energy drinks that are sold in convenience stores and at rest stops along major highways. The drinks provide a burst of energy that can keep drivers alert for long distances. The company has been in business for three years and is experiencing growth due to an increase in demand for its energy drink from people who find their jobs draining. The company has launched a national advertising program that should boost its sales even more.

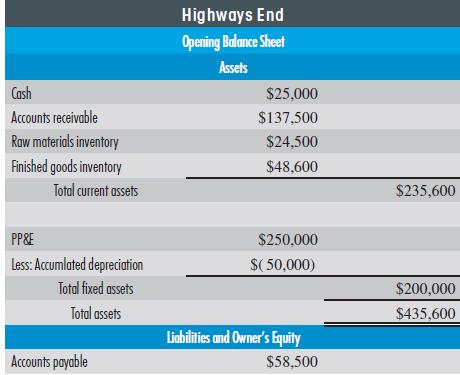

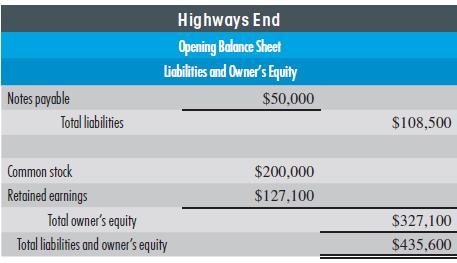

As a wholesaler dealing directly with retail customers, Highways End needs to keep a careful eye on its cash flow to ensure that it meets future demand without lack of cash causing it to go out of business. The data you need to do a flexible budget for the year ahead for Highways End are in Highways End’s opening balance sheet below:

• Sales for the last quarter of 20x6 were $275,000. Budgeted sales for 20x7 are $300,000 in Quarter 1, $325,000 in Quarter 2, $350,000 in Quarter 3, and $375,000 in Quarter 4. Total sales for the first quarter of 20x7 are expected to hit $400,000, with the second quarter projected to reach $425,000. Each bottle of Highway s End energy drink sells for $1.25.

• 50% of the company ’s customers pay in the quarter they buy the merchandise; 50% pay in the next quarter.

• The company keeps 25% of the next quarter’s sales on hand in ending inventory.

• Raw materials are the container for the product, which cost $0.05 each, and the actual product, which costs $0.15 per fluid ounce. There are three fluid ounces in a bottle.

• Highways End pays for 50% of raw materials purchases in the quarter of production and 50% in the following quarter. It pays all other costs in the quarter in which they are incurred.

• It keeps ending raw materials inventory at 20% of the next quarter’s production. It expects costs of raw materials to be stable in 20x7.

• It takes 0.010 hours to fill one bottle of energy fluid. Each labor hour costs the firm $22.

• Variable overhead is $0.05 per unit made. Fixed overhead includes rent for $9,000 per quarter, filling machine costs of $4,000 per quarter, supervision of $9,000 per quarter, and general overhead of $3,000 per quarter.

• Factory depreciation is $10,000 per quarter.

• Variable selling costs are $0.05 per unit. Fixed quarterly SG&A overhead costs are $4,000 for fixed selling costs, $5,000 for marketing costs, $6,000 for administrative costs, and $1,200 for general overhead costs.

• Income taxes are 30% of income before tax .

REQUIRED:

For the coming year, complete:

a. A sales budget

b. A production budget

c. A raw materials budget for each raw material used in the energy drinks

d. A labor budget

e. An overhead budget

f. An ending finished goods budget

g. A cost of goods sold budget

h. An SG&A budget

i. An income statement

j. A cash receipts budget

k. A cash disbursements budget

l. A cash budget

m. An ending balance sheet

Step by Step Answer:

Managerial Accounting An Integrative Approach

ISBN: 9780999500491

2nd Edition

Authors: C J Mcnair Connoly, Kenneth Merchant