Parlance, Inc., has three divisions that it is trying to evaluate to determine which division should get

Question:

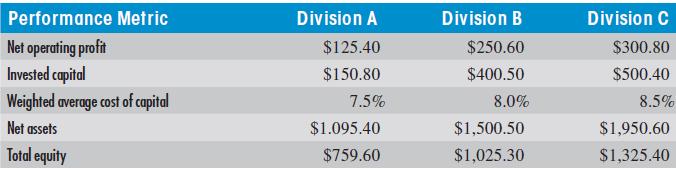

Parlance, Inc., has three divisions that it is trying to evaluate to determine which division should get the largest share of the capital available for new projects for the coming year. Sam Peabody, Parlance’s CEO, believes it is best to evaluate how well the divisions have done with the money entrusted to them to this stage if he is going to make a good investment decision moving forward. He collects the following data on the three divisions, all of which is stated in millions of dollars.

REQUIRED:

a. Calculate the RI for each of the three divisions.

b. Calculate the ROI for each of the divisions.

c. Calculate the return on net assets (RONA) for each of the divisions.

d. Calculate the return on equity (ROE) for each of the three divisions.

e. Which division is doing the best (for example, should receive more capital this year)? Why?

Step by Step Answer:

Managerial Accounting An Integrative Approach

ISBN: 9780999500491

2nd Edition

Authors: C J Mcnair Connoly, Kenneth Merchant