Prestige Autos president, Jack Noble, is doing some planning for the coming year. The auto dealership faces

Question:

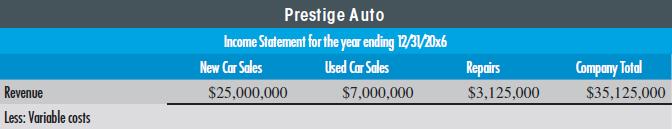

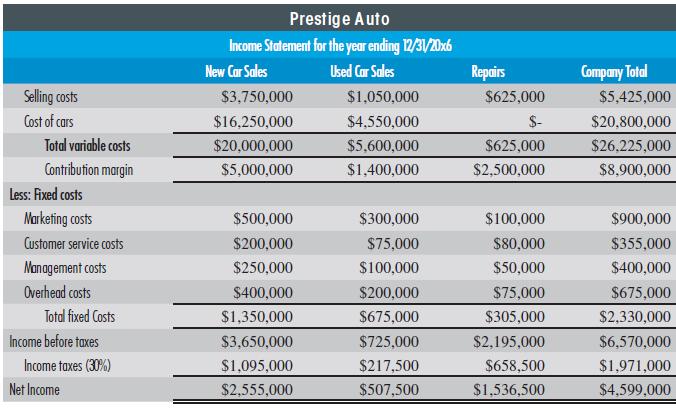

Prestige Auto’s president, Jack Noble, is doing some planning for the coming year. The auto dealership faces both fixed and variable costs. For new and used cars, the variable selling costs are currently 15% of revenue (commissions), while the variable cost of the car itself averages 65% of the revenue earned. For repair services, the variable costs of running the repair facility are 20% of revenues. All of the fixed costs are as noted in the following income statement.

Starting with the income statement for 20x6, Jack decides to test the following assumptions:

Starting with the income statement for 20x6, Jack decides to test the following assumptions:

• Scenario 1: Sales increase 25% due to a new line of Mercedes being released. Preliminary reports from the field are that the new line is exceptionally strong. Fixed sales and marketing would increase by 15% so that the showroom could handle the new volume. Variable selling costs would go up by 10% while the variable cost of the car itself would remain constant. Other new car fixed costs would go up 5%. Repair revenues and their variable costs will increase 10%. Used car sales would also increase 10% with a 5% increase in their variable costs. Neither repairs nor used cars would face any increase in fixed costs. Jack feels this scenario, the optimistic one, has a 30% chance of occurring.

• Scenario 2: Sales increase 15% as normally happens when Prestige introduces new models. One salesperson, who will be paid $30,000 in addition to the existing commission structure (variable selling costs), would be added. Variable selling costs would go up 5% with the new volume, but the variable cost of the car itself would remain a constant percentage. Repairs revenue and their variable costs would increase 5%. Repairs fixed costs would be unchanged. Used car sales would increase 5% with no increase in its fixed or variable cost percentage. Jack feels this scenario, the most likely one, has a 50% chance of occurring.

• Scenario 3: Sales only increase 5% because the new models fail to live up to their reputation. Therefore, Jack would not add another salesperson. All costs remain static with variable costs staying at the same percentage of sales and fixed costs. Repairs and used car sales would remain steady with no relevant increase in revenues or costs. Jack feels this scenario, the pessimistic one, has a 20% chance of occurring.

REQUIRED:

a. Using the templates provided in the database for this problem, change the key assumptions as noted in each of the scenarios. Be careful when you come to the increase in variable costs as this is a percentage of existing variable costs. For instance, if variable costs are currently 5% and they increase 25%, you multiply 5% by 1.25 to get the new percentage, which is 6.25%.

b. What is the expected value of the options available to Jack?

c. What should Jack plan for? Why?

Step by Step Answer:

Managerial Accounting An Integrative Approach

ISBN: 9780999500491

2nd Edition

Authors: C J Mcnair Connoly, Kenneth Merchant