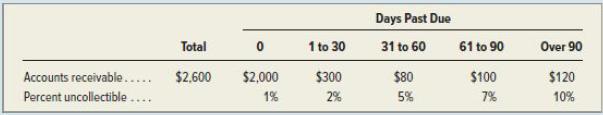

1. It prepared the following aging of receivables analysis. (a) Estimate the balance of the Allowance for...

Question:

1. It prepared the following aging of receivables analysis.

(a) Estimate the balance of the Allowance for Doubtful Accounts using the aging of accounts receivable method.

(b) Prepare the adjusting entry to record bad debts expense using the estimate from part

a. Assume the unadjusted balance in the Allowance for Doubtful Accounts is a $10 debit.

2. Refer to the data in part 1.

(a) Estimate the balance of the Allowance for Doubtful Accounts assuming the company uses 2%

of total accounts receivable to estimate uncollectibles instead of the aging of receivables method in part 1.

(b) Prepare the adjusting entry to record bad debts expense using the estimate from part 2a. Assume the unadjusted balance in the Allowance for Doubtful Accounts is a $4 credit.

3. Refer to the data in part 1.

(a) Estimate the balance of the uncollectibles assuming the company uses 0.5% of annual credit sales (annual credit sales were $10,000).

(b) Prepare the adjusting entry to record bad debts expense using the estimate from part 3a. Assume the unadjusted balance in the Allowance for Doubtful Accounts is a $4 credit.

Step by Step Answer: