A company is considering two potential projects. Each project requires a ($ 20,000) initial investment and is

Question:

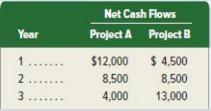

A company is considering two potential projects. Each project requires a \(\$ 20,000\) initial investment and is expected to generate annual net cash flows as follows. Assuming a discount rate of \(10 \%\), compute the net present value of each project. If only one project can be selected, which is chosen?

Transcribed Image Text:

Year 1 2..... 3 ** Net Cash Flows Project A Project B $12,000 8,500 4,000 $ 4,500 8,500 13,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 75% (4 reviews)

Net present values follow Because the projects have the sa...View the full answer

Answered By

Daniel Kimutai

I am a competent academic expert who delivers excellent writing content from various subjects that pertain to academics. It includes Electronics engineering, History, Economics, Government, Management, IT, Religion, English, Psychology, Sociology, among others. By using Grammarly and Turnitin tools, I make sure that the writing content is original and delivered in time. For seven years, I have worked as a freelance writer, and many scholars have achieved their career dreams through my assistance.

5.00+

1+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

21st Century Educational Products (21st Century) is a rapidly growing software company; and consistent with its growth, it has a relatively large capital budget. While most of the companys projects...

-

I have posted this question twice, but i didn't get the correct answer yet, please read the question carefully before answering. I do not need an answer for the 3.1 and I need answer for 3.2 which is...

-

LAM Corp paid a dividend of $ 4 per share to its stock holder yesterday. LAM's dividend is expected to increase oftherate of 20 percent per year for the next four years Four years from now , you...

-

On November 1, 2018, the following were the account balances of Mountain Equipment Repair Limited. Mountains year-end is October 31 and it records adjusting entries monthly. Enter the November 1...

-

Air at 150 kPa, 290 K expands to the atmosphere at 100 kPa through a convergent nozzle with exit area of 0.01 m2. Assume an ideal nozzle. What is the percent error in mass flow rate if the flow is...

-

The bar DA is rigid and is originally held in the horizontal position when the weight W is supported from C. If the weight causes B to displace downward 0.025 in., determine the strain in wires DE...

-

Two people differ in age by 1.5 years. Their heights and weights are the same, and their lung capacities are measured at the same pressure and temperature. By how much should we predict their lung...

-

The MFG Corporation is planning to produce and market three different products. Let x1, x2, and x3 denote the number of units of the three respective products to be produced. The preliminary...

-

The property, plant, and equipment accounts for Cheyenne Company held the following opening balances on January 1, 2023 (the first day of Cheyenne's fiscal year): Land $519,000 Equipment 798,000...

-

A company is considering the purchase of equipment for \(\$ 270,000\). Projected annual net cash flow from this equipment is \(\$ 61,200\) per year. The payback period is a. 0.2 years. b. 5.0 years....

-

Compute the accounting rate of return for the machine investment below. Initial investment Salvage value. Income (annual)..... $180,000 20,000 40,000

-

What is a mutual funds net asset value (NAV)? How is the NAV calculated and reported?

-

D. Sale is employed at an annual salary of $27,396 paid semi-monthly. The regular workweek is 36 hours. (a) Whats the regular salary per pay period? (b) What is the hourly rate of pay? (c) What is...

-

Find the slope and the y-intercept of the line with the given equation. y=5-7x The slope is m= (Type an integer or a simplified fraction.) The y-intercept is (Type an integer or a simplified...

-

The electrical potential at any point (x, y) on a plate is given by V(x, y) = 50x + x + y + 2. (a) At the point (1,-1), in what direction is the electric potential increasing most rapidly? Draw an...

-

Consider the function f(x) = defined on x+1 [-10,10]. We define x = -10 + ih, where i = 0,..., n and h = 20 with n = 11, 21, 41, 81. Write n 1. a MATLAB script to 1. Calculate a numerical...

-

The Cullumber Theater Inc. was recently formed. It began operations in March 2025. The Cullumber is unique in that it will show only triple features of sequential theme movies. On March 1, the ledger...

-

Identify three prominent figures in the Harlem Renaissance, note the contributions of each, and note their collective impact on American society.

-

Data on weekday exercise time for 20 females, consistent with summary quantities given in the paper An Ecological Momentary Assessment of the Physical Activity and Sedentary Behaviour Patterns of...

-

Adidas AG reports the following balance sheet accounts for the year ended December 31, 2013 (euros in millions). Prepare the balance sheet for this company as of December 31, 2013, following usual...

-

Refer to the balance sheet and income statement for Apple in Appendix A. What does the company title its inventory account? Does the company present a detailed calculation of its cost of goods sold?

-

Refer to Googles income statement in Appendix A. What title does it use for cost of goods sold?

-

8. Suppose P is a cubic polyhedron that contains only 4-sided, 6-sided, and 8-sided faces. [10 points] (a) Determine a formula for the number of 4-sided faces in terms of the number of 8-sided faces....

-

Saleh sold the following stock in 2021. ABC, Incorporated, is a 1202 qualified small business (QSB). Asset ABC, Incorporated, 200 shares DEF, Incorporated, 100 shares Cost $ 153,000 Acquired Sale...

-

F-25 Let P3 have the inner product given by evaluation at -7, -1, 1, and 7. Let po (t) = 2, p (t) = 4t, and q(t) = 24 Notice that these polynomials form an orthogonal set with this inner product....

Study smarter with the SolutionInn App