Acquisition, Cost Allocation, and Disposal of Tangible and Intangible Assets On July 1, Year 1, Tulsa Company

Question:

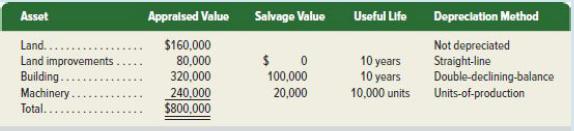

Acquisition, Cost Allocation, and Disposal of Tangible and Intangible Assets On July 1, Year 1, Tulsa Company pays $600,000 to acquire a fully equipped factory. The purchase includes the following assets.

Required

1. Allocate the total $600,000 purchase cost among the separate assets in the table above.

2. Compute the Year 1 (six months) and Year 2 depreciation expense for each asset in the table above. The machinery produced 700 units in Year 1 and 1,800 units in Year 2.

3. Tulsa also discarded equipment at year-end that had been on its books for five years. The equipment’s original cost was $12,000 (estimated life of five years) and its salvage value was $2,000. No depreciation had been recorded for the fifth year when the disposal occurred. Journalize the fifth year of depreciation (straight-line method) and the asset’s disposal.

4. On January 1 of the current year, Tulsa purchased a patent for $100,000 cash. The company estimated the patent’s useful life to be 10 years. Journalize the patent acquisition and its amortization for this year.

5. Tulsa also acquired an ore deposit for $600,000 cash. It added roads and built mine shafts for an additional cost of $80,000.

Salvage value of the mine is estimated to be $20,000. The company estimated 330,000 tons of available ore. During the first year, Tulsa mined and sold 10,000 tons of ore. Journalize the mine’s acquisition and its first year’s depletion.

Step by Step Answer: