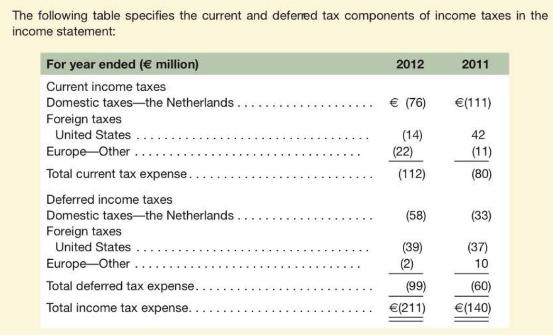

Ahold, a grocery and retail company located in The Netherlands, reports the following footnote for income taxes

Question:

Ahold, a grocery and retail company located in The Netherlands, reports the following footnote for income taxes in its 2012 annual report.

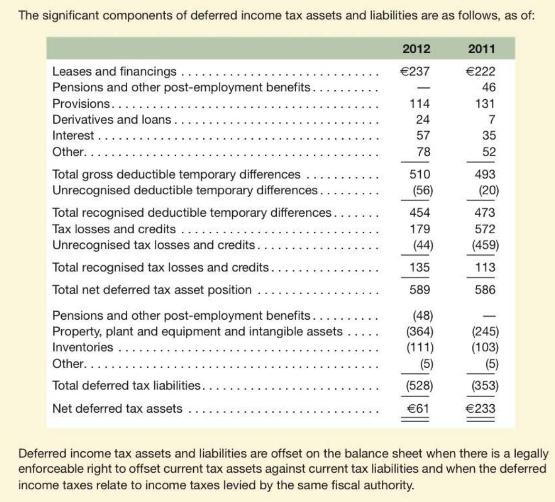

c. Ahold reports a deferred tax asset relating to provisions. Footnotes to financial statements indicate that these provisions relate, in part, to self-insurance accruals. When a company self-insures, it does not purchase insurance from a third-party insurance company. Instead, it records an expense and related liability to reflect the probable payment of losses that can occur in the future. Explain why this accrual (provision) results in a deferred tax asset.

d. Ahold reports deferred tax assets relating to tax losses and credits. Explain how these arise and how they will result in a future benefit.

e. The company reports unrecognized temporary differences and unrecognized tax losses and credits. These are the IFRS equivalent of valuation allowances in U.S. GAAP. Why did the company set up these unrecognized portions of deferred tax assets? How did the net decrease in the combined unrecognized amounts from 2011 to 2012 affect net income? How can a company use these accounts to meet its income targets in a particular year?

Step by Step Answer:

Financial And Managerial Accounting For MBAs

ISBN: 9781618533593

6th Edition

Authors: Peter D. Easton