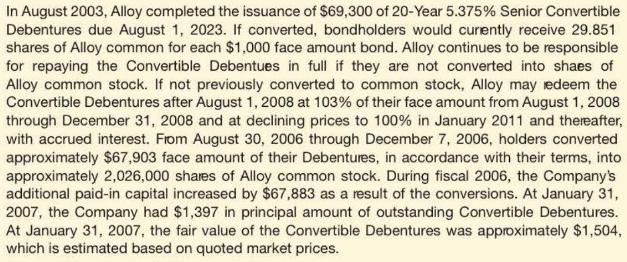

Alloy, Inc., reports the following footnote related to its convertible debentures in its 2007 10-K ($ thousands).

Question:

Alloy, Inc., reports the following footnote related to its convertible debentures in its 2007 10-K (\$ thousands).

Required

a. How did Alloy initially account for the issuance of the \(5.375 \%\) debentures, assuming that the conversion option cannot be detached and sold separately?

b. Consider the conversion terms reported in the footnote. At what minimum stock price would it make economic sense for debenture holders to convert to Alloy common stock?

c. Use the financial statement effects template to show how Alloy accounted for the conversion of the \(5.375 \%\) debentures in 2006 . The par value of the company's stock is \(\$ 0.01\).

d. Assume that the conversion feature is valued by investors and, therefore, results in a higher initial issuance price for the bonds. What effect will the conversion feature have on the amount of interest expense and net income that Alloy reports?

e. How are the convertible debentures treated in the computation of basic and diluted earnings per share (EPS)?

Step by Step Answer:

Financial And Managerial Accounting For MBAs

ISBN: 9781618533593

6th Edition

Authors: Peter D. Easton