Cortino Company is planning to add a new product to its line. To manufacture this product, the

Question:

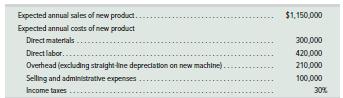

Cortino Company is planning to add a new product to its line. To manufacture this product, the company needs to buy a new machine at a $300,000 cost with an expected four-year life and a $20,000 salvage value. All sales are for cash and all costs are out-of-pocket, except for depreciation on the new machine.

Additional information includes the following.

Required 1. Compute straight-line depreciation for each year of this new machine’s life. (Round depreciation amounts to the nearest dollar.)

2. Determine expected net income and net cash flow for each year of this machine’s life. (Round answers to the nearest dollar.)

3. Compute this machine’s payback period, assuming that cash flows occur evenly throughout each year.

(Round the payback period to two decimals.)

4. Compute this machine’s accounting rate of return, assuming that income is earned evenly throughout each year. (Round the percentage return to two decimals.)

5. Compute the net present value for this machine using a discount rate of 7% and assuming that cash flows occur at each year-end. (Hint: Salvage value is a cash inflow at the end of the asset’s life.)

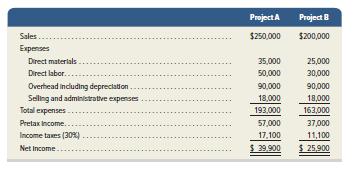

Aikman Company has an opportunity to invest in one of two projects. Project A requires a $240,000 investment for new machinery with a four-year life and no salvage value. Project B also requires a $240,000 investment for new machinery with a three-year life and no salvage value. The two projects yield the following predicted annual results. The company uses straight-line depreciation, and cash flows occur evenly throughout each year.

Required 1. Compute each project’s annual expected net cash flows. (Round net cash flows to the nearest dollar.)

2. Determine each project’s payback period. (Round the payback period to two decimals.)

3. Compute each project’s accounting rate of return. (Round the percentage return to one decimal.)

4. Determine each project’s net present value using 8% as the discount rate. For part 4 only, assume that cash flows occur at each year-end. (Round net present values to the nearest dollar.)

Analysis Component 5. Identify the project you would recommend to management and explain your choice.

Step by Step Answer:

Financial And Managerial Accounting Information For Decisions

ISBN: 9781259726705

7th Edition

Authors: John Wild, Ken Shaw, Barbara Chiappetta