For the year ended December 31, 20Y2, the operating results of Paley Corporation and its wholly owned

Question:

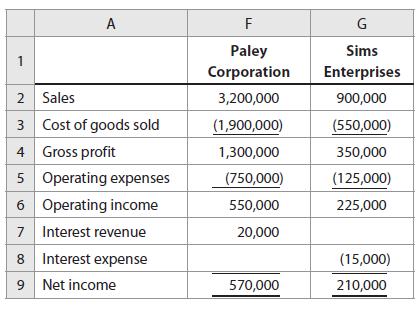

For the year ended December 31, 20Y2, the operating results of Paley Corporation and its wholly owned subsidiary, Sims Enterprises, are as follows:

During 20Y2, Sims Enterprises sold and received payment of $80,000 for merchandise that was purchased by Paley Corporation. The merchandise sold to Paley cost Sims Enterprises $45,000.

Paley Corporation sold the merchandise to another (nonaffiliated) company for $110,000.

a. Prepare a consolidated income statement for Paley Corporation and Subsidiary.

b. Assume that as of December 31, 20Y2, Paley Corporation had not sold the merchandise purchased from Sims Enterprises. How would this affect the preparation of the consolidated financial statements?

c. Assume that $15,000 of the interest revenue that Paley Corporation reported on its income statement was from a note payable from Sims Enterprises. Sims paid the note payable at its maturity in 20Y2. How would the loan affect the preparation of the consolidated financial statements?

Step by Step Answer:

Financial And Managerial Accounting

ISBN: 9780357714041

16th Edition

Authors: Carl S. Warren, Jefferson P. Jones, William Tayler