Intel Corporation reported the following in its 2012 10-K report. Required a. What did Intel expense for

Question:

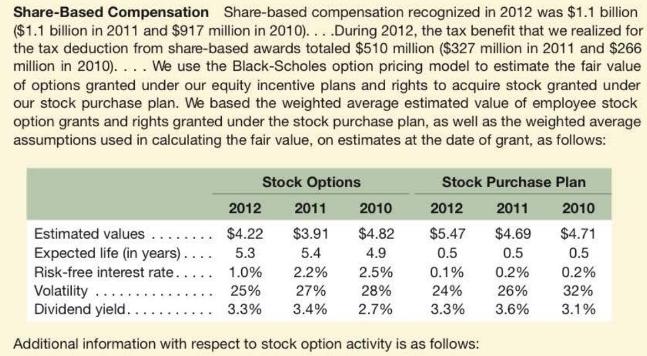

Intel Corporation reported the following in its 2012 10-K report.

Required

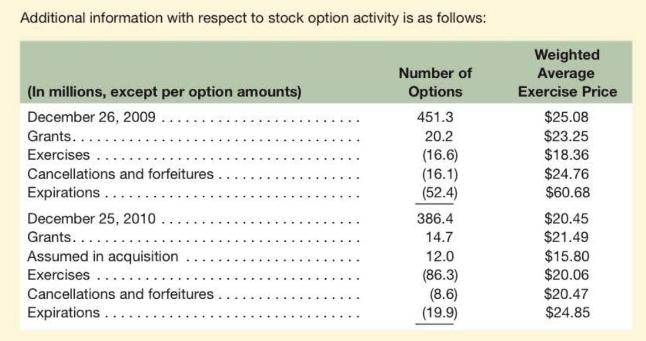

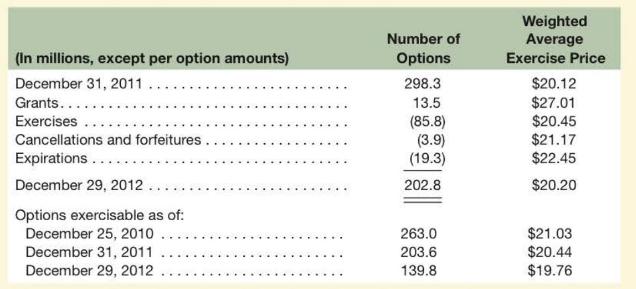

a. What did Intel expense for share-based compensation for 2012? How many options did Intel grant in 2012? Compute the fair value of all options granted during 2012. Why do the fair value of the option grants and the expense differ?

b. Intel used the Black-Scholes formula to estimate fair value of the options granted each year. How did the change in volatility from 2011 to 2012 affect share-based compensation in 2012? What about the change in risk-free rate?

c. How many options were exercised during 2012? Estimate the cash that Intel received from its employees when these options were exercised.

d. What was the intrinsic value per share of the options exercised in 2012? If employees who exercised options in 2012 immediately sold them, what "profit" did they make from the shares? (Hint: Assume that Intel grants options at-the-money.)

e. The tax benefit that Intel will receive on the options exercised is computed based on the intrinsic value of the options exercised. Estimate Intel's tax benefit from the 2012 option exercises assuming a tax rate of \(37 \%\)

f. What was the average exercise price of the 19.3 million options expired in 2012? Explain what benefit the employees lost by not exercising their options.

Step by Step Answer:

Financial And Managerial Accounting For MBAs

ISBN: 9781618533593

6th Edition

Authors: Peter D. Easton