On December 29, 2006, AT&T acquired Bell South. Prior to the acquisition, AT&T and Bell South jointly

Question:

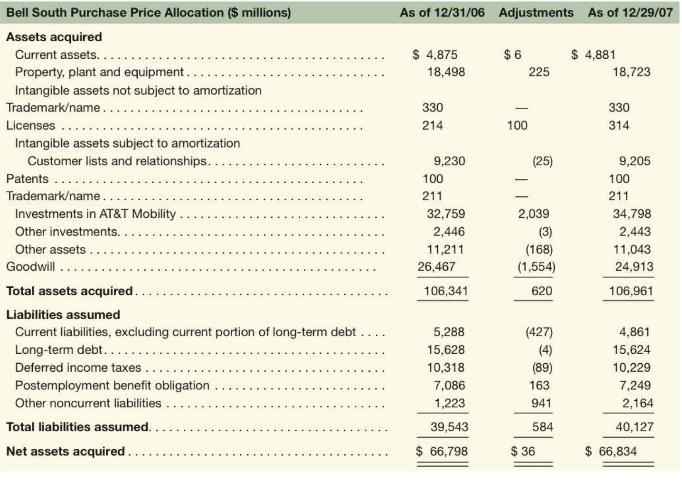

On December 29, 2006, AT\&T acquired Bell South. Prior to the acquisition, AT\&T and Bell South jointly owned AT\&T Mobility (formerly known as Cingular Wireless) and each accounted for its investment in AT\&T Mobility under the equity method. AT\&T purchased Bell South for \(\$ 66,834\) million and reported the following allocation of the purchase price in its 2007 10-K:

a. Describe how AT\&T accounts for its investment in AT\&T Mobility (formerly Cingular Wireless) following its acquisition of Bell South.

b. AT\&T had the following disclosure in its 2007 10-K regarding the reporting of its investment in AT\&T Mobility: "We recorded the consolidation of AT\&T Mobility as a step acquisition, retaining \(60 \%\) of AT\&T Mobility's prior book value and adjusting the remaining \(40 \%\) to fair value." Why is AT\&T only adjusting \(40 \%\) of its investment in AT\&T Mobility to fair value?

c. AT\&T adjusted the purchase price allocation for Bell South subsequent to the acquisition. Most of the allocation relates to an increased value placed on Bell South's equity investment in AT\&T Mobility due to "increased value of licenses and customer lists and relationships acquired." Why did the increase in the allocation of the purchase price to Bell South's investment in AT\&T Mobility decrease the allocation to goodwill? How will this increase in allocation to the equity investment impact AT\&T's income statement?

d. More than half of the purchase price is allocated to intangible assets and goodwill. How is the fair value of customer lists and relationships estimated? How is the fair value of goodwill estimated? Why does it matter whether the allocation of the purchase price for intangible assets relates to "customer lists and relationships" or to goodwill?

Step by Step Answer:

Financial And Managerial Accounting For MBAs

ISBN: 9781618533593

6th Edition

Authors: Peter D. Easton