Pool Pro produces and sells liquid chlorine for swimming pools. The company annually produces and sells 300,000

Question:

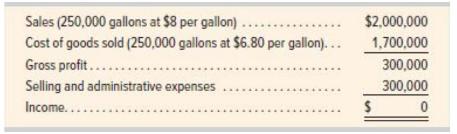

Pool Pro produces and sells liquid chlorine for swimming pools. The company annually produces and sells 300,000 gallons of its chlorine. Because of this year's cool summer, projected demand for its product is only 250,000 gallons. Based on projected production and sales of 250,000 gallons, the company estimates the following income using absorption costing.

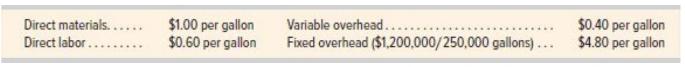

Its product cost per gallon follows and consists mainly of fixed overhead because its automated production process uses expensive equipment.

Selling and administrative expenses consist of variable selling and administrative expenses of \(\$ 0.80\) per gallon and fixed selling and administrative expenses of \(\$ 100,000\) per year. The company's president will not earn a bonus unless a positive income is reported. The controller suggests that because the company has large storage capacity, it can report a positive income by setting its production at the usual 300,000 gallon level even though it expects to sell only 250,000 gallons. The president is surprised that the company can report income by producing more without increasing sales.

Required

1.

(a) Prepare an income statement using absorption costing based on production of 300,000 gallons and sales of 250,000 gallons.

(b) Can the company report positive income by increasing production to 300,000 gallons and storing the 50,000 gallons of excess production in inventory?

2. Should the company produce 300,000 gallons given that projected demand is 250,000 gallons? Explain, and refer to any ethical implications of such a managerial decision for income reporting.

Step by Step Answer: