Reproduced below is the debt footnote from the 2013 10-K report of Dell Inc. Reproduced below is

Question:

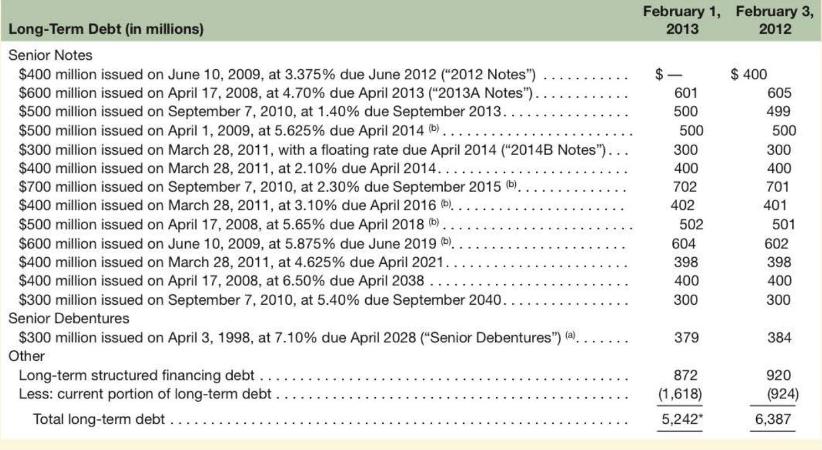

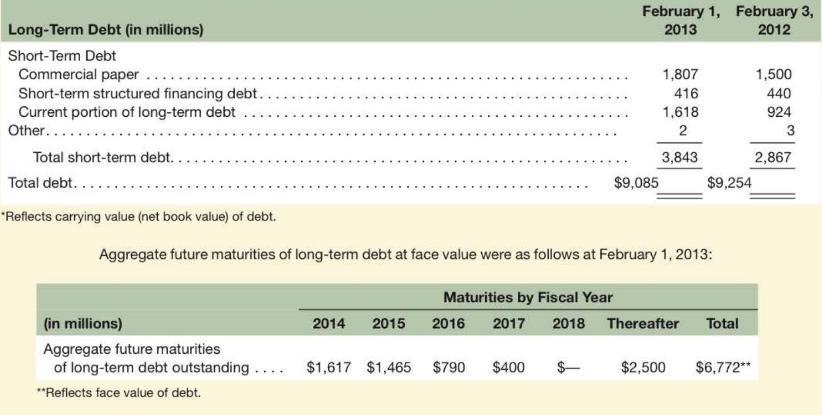

Reproduced below is the debt footnote from the 2013 10-K report of Dell Inc.

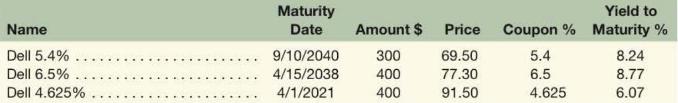

Reproduced below is a summary of the market values as of November 2013 of the Dell bonds maturing from 2021 to 2040 (from Morningstar, quicktake.morningstar.com).

Required

a. What is the amount of long-term debt reported on Dell's February 1, 2013, balance sheet? What are the scheduled maturities for this indebtedness? Why is information relating to a company's scheduled maturities of debt useful in an analysis of its financial condition?

b. Dell reported \(\$ 270\) million in interest expense in the notes to its 2013 income statement. In the note to its statement of cash flows, Dell indicates that the cash portion of this expense is \(\$ 279\) million. What could account for the difference between interest expense and interest paid? Explain.

c. Dell's long-term debt is rated Baal by Moody's, BBB + by S\&P, and BBB + by Fitch. What factors would be important to consider in attempting to quantify the relative riskiness of Dell compared with other borrowers? Explain.

d. Dell's \(\$ 300\) million \(5.4 \%\) notes traded at 69.5 or \(69.5 \%\) of par, as of November 2013 . What is the market value of these notes on that date? How is the difference between this market value and the \(\$ 300\) million face value reflected in Dell's financial statements? What effect would the repurchase of this entire note issue have on Dell's financial statements? What does the 69.5 price tell you about the general trend in interest rates since Dell sold this bond issue? Explain.

e. Examine the yields to maturity of the three bonds in the table above. What relation do we observe between these yields and the maturities of the bonds? Also, explain why this relation applies in general.

Step by Step Answer:

Financial And Managerial Accounting For MBAs

ISBN: 9781618533593

6th Edition

Authors: Peter D. Easton