Stay-In-Style (SIS) Hotels Inc. is considering the construction of a new hotel for $30 million. The expected

Question:

Stay-In-Style (SIS) Hotels Inc. is considering the construction of a new hotel for $30 million. The expected life of the hotel is 10 years, with no residual value. The hotel is expected to earn revenues of $25 million per year. Total expenses, including straight-line depreciation, are expected to be $20 million per year. Stay-In-Style Hotels’ management has set a minimum acceptable rate of return of 20%.

a. Determine the equal annual net cash flows from operating the hotel.

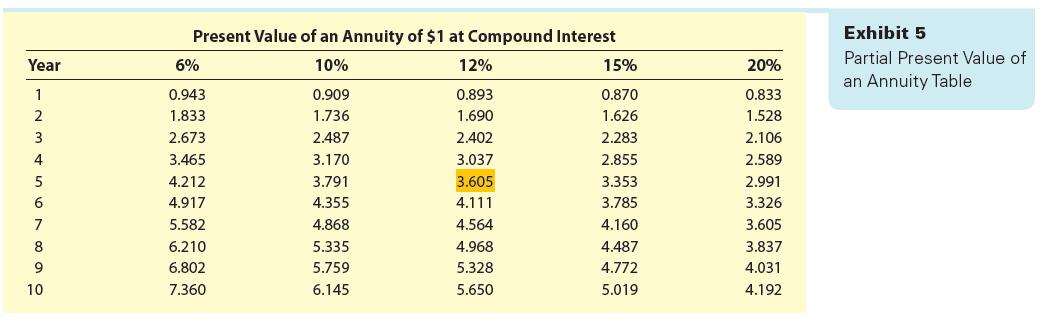

b. Compute the net present value of the new hotel, using the present value of an annuity table found in Exhibit 5. Round to the nearest million dollars.

c. Does your analysis support construction of the new hotel? Explain.

Exhibit 5

Step by Step Answer:

Financial And Managerial Accounting

ISBN: 9780357714041

16th Edition

Authors: Carl S. Warren, Jefferson P. Jones, William Tayler